This question was submitted by a user of EasyForm8889.com. Feel free to send in your question today to evan@hsaedge.com.

I don’t know where to find the amount I contributed to my HSA. The IRS says I had $774 in my HSA account. My W2 says my employer contributed $850. Does this make sense?

The bad way to determine your HSA contribution

First off, using your bank account, HSA transaction history, or W2 isn’t the way to determine your HSA contributions for a given year. Why is this? While these numbers may often equal the amount you contributed to your HSA, they may not equal what was reported to the IRS as contributed to the HSA. Mistakes happen, and sometimes your HSA administrator will miss a contribution or mess up the dollar amount. If this happens, they will report a different amount than you report on your taxes. This discrepancy can be a red flag to the IRS, which is why it is critical to have a “source of truth” for your HSA contributions. This serves as the official amount contributed to your HSA for the year, and if it is not correct, you can have your custodian fix it fairly easily.

Form 5498-SA reports contributions for the year

Each year, your HSA custodian (bank where you have account) is required to send you IRS Form 5498-SA. This form provides an accounting of all contributions to your HSA for the tax year, including personal, employer, prior year, and rollover contributions. Form 5498-SA is the “source of truth” we describe above, and is the final say in what was contributed. It is basically the “writing in stone” between you, your HSA custodian, and the IRS. Thus, if it is not correct, contact your custodian and make it so.

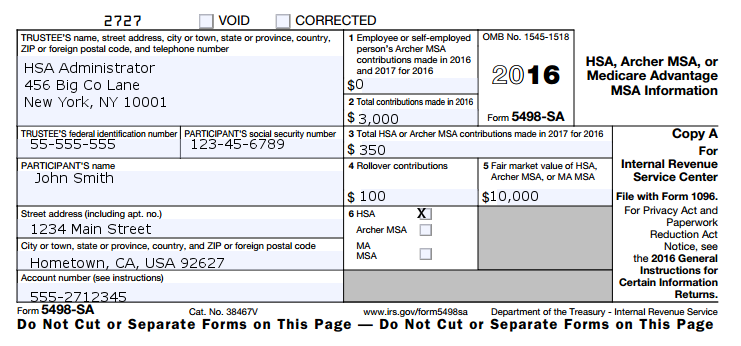

Here is an example of what Form 5498-SA looks like:

For more detailed information on Form 5498-SA, please see this article.

Where is my Form 5498-SA?

Your HSA custodian is required to send you this form each year before you file your taxes. Generally, you should get the form by January 31st. However, mail gets lost or sent to wrong addresses. If you do not have your Form 5498-SA, don’t worry, you should be able to find this form on your custodian’s website in the document archive. Worst case, give them a call and ask to resend it or email it to you.

Why HSA Contribution amounts are important

Getting your HSA contribution amount is critical when you go to file Form 8889 each year, as an incorrect value can cost you money. If you under report your contribution to your HSA, you will not receive the tax deducation that Form 8889 allows you (by means of Form 1040). You basically did all the hard work for the HSA and didn’t get any benefit. On the other hand, if you over report your contribution, you risk taking too much of a deduction. This results in filing your taxes wrong and spending time dealing with fixing them or wost case, a friendly chat with the IRS.

————————————

Note: if you need help calculating your contribution on your HSA taxes this year, please consider using my service EasyForm8889.com to complete Form 8889. It is fast and painless, no matter how complicated your HSA situation.