This question was submitted by HSA Edge reader James. Feel free to send in your question today to evan@hsaedge.com.

I read your article on “Contributing to HSA’s with a Cafeteria Plan” and have a question. I am a federal employee with the Aetna High Deductible Health Plan. The government automatically deducts my premiums from each paycheck pretax through premium conversion. Aetna contributes $1,500 to my HSA each year. Where do I report Aetna’s $1,500 contribution on Form 8889?

One of the benefits of Health Savings Accounts is that literally anyone willing can make a contribution to your HSA on your behalf. This means that if you have a parent, grandparent, rich uncle, friendly employer, or random organization that wants to give you money for your medical care, you can accept it in your HSA.

HSA Contributions from Others are Tax Deductible

As if receiving free money wasn’t enough, the IRS gives you another special bonus for HSA contributions from others on your behalf. Incredibly, these contributions from others are deductible on your return. Yes, you read that right: if you receive HSA contributions from another person, you receive a tax deduction for this money. Per Form 969:

In the above, “eligible individual” is the term for the HSA account holder. The result of this amazing tax treatment is that it trues up these other funds going into your HSA, and in effect gives them the same tax preferred status as your regular HSA contributions. In other words, if you receive a an HSA contribution from another on your behalf, you get the contribution as well as the deduction equal to the contribution amount times your marginal tax rate. Score!

Reporting Other HSA Contributions on Form 8889

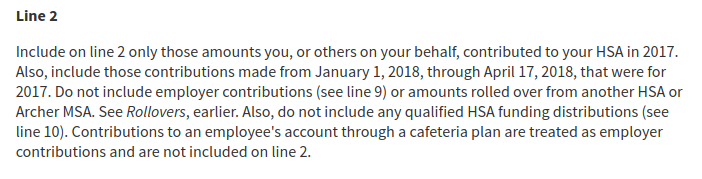

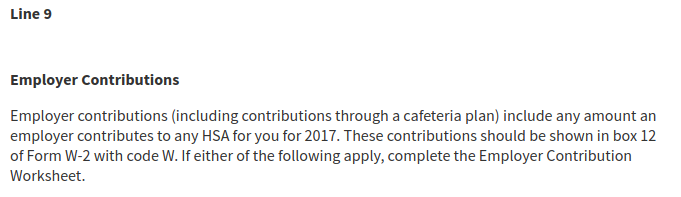

Come tax time, reporting these contributions on Form 8889 can be a complication. Two lines on that form are used to report regular contributions to the HSA. Line 2 is used to report pre-tax contributions that you made during the year. Amounts on this line will reduce your taxable income. Line 9, on the other hand, is called Employer Contributions and amounts here do not reduce your taxable income. The “contributions from others” do not fall neatly into these categories, and are sort of in an “in between” zone.

Luckily, the Form 8889 instructions provide guidance on this situation. Comparing the two tax form lines, you can see that this situation is explicitly handled:

Per your question, it is not entirely clear if Aetna is contributing as your employer or as another entity. Since they are an insurance company, my guess is as another entity i.e. as another on your behalf. In this case, it is the best possible scenario, as you get the free money and get to deduct the contribution.

Note: if you need help recording your contribution on your HSA taxes this year, please consider using my service EasyForm8889.com to complete Form 8889. It is fast and painless, no matter how complicated your HSA situation.