This question was submitted by HSA Edge reader Dave. Feel free to send in your question today to evan@hsaedge.com.

My spouse became unemployed and we want to use our HSA to pay our premium under IRS rules. However, we have a family plan with both of us on it. Can I use the funds to pay the entire premium or do I need to prorate it to her portion for payment tax free from the HSA?

Using HSA for Insurance Premiums

Sorry to hear that your spouse is in this situation. Using HSA funds to pay for insurance premiums is a great benefit of HSA’s and one way they provide an unemployment safety net.

First off, make sure that your spouse is receiving unemployment compensation from the state or federal government. This means signing up for unemployment benefits and being receiving actual money from a government entity. Do this as soon as possible. Why? Besides receiving funds that will help you during this time, this step is required to treat premiums as qualified medical expenses. Moreover, it is the sole justification in the event anyone at the IRS asks why your premiums were treated as such.

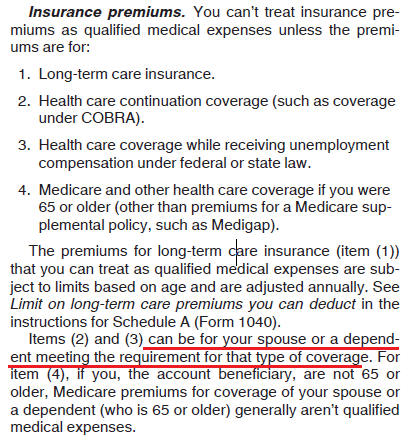

Your HSA can pay for health care coverage while receiving unemployment compensation under federal or state law.

You will need this evidence for each month you treat the premium as a qualified medical expense, and hence, pay for it with your HSA.

Considerations for Family Coverage

Now that you have met the prerequisites, you can pay for your health insurance using your HSA. This has two main benefits:

- Cash flow – you use previously saved funds for current expenses

- Tax deduction – you use tax free funds for the insurance premiums

As for the amount of the premium, can see the IRS guidance from Form 969 below. It is admittedly vague on this topic but I don’t see any reason you need to prorate the insurance premium only for your spouse.

In fact, the spouse case is called out in the highlighted area. if the intent was to split the premium they would have said so explicitly there. Instead, there is no mention of prorating any premium amount, and instead the rules state that “if conditions are met, you may pay for the premium”. Without any mention of prorating, I don’t see it as required. Going a step further, requiring the premium be prorated would be messy and dilute the benefit significantly. For example, consider the case of family coverage with 2 dependents: would only 25% of the premium be HSA eligible?

Based on the above, my take is that if anyone on the family coverage is receiving unemployment benefits, the entire premium can be paid with the HSA.

Note: I created TrackHSA.com to track medical expenses you pay using Health Savings Account, even insurance premiums. It provides record keeping to store purchases, upload receipts, and record reimbursements securely online.