This question was sent in by HSA Edge reader Holly. Feel free to send in your own question.

I have an employee (who has Cigna insurance for himself and his family) whose daughter is now employed and has insurance of her own. He would like to leave her on his plan until she turns 26 in October. She would then have her insurance as her primary and dad’s insurance as secondary. Is this allowed?

Parent with Adult Child with Secondary Insurance

Let’s address this from two perspectives: for one, I see no problem for the employee to have his daughter on his health plan. Assuming he has an HDHP, he is eligible to contribute to an HSA using the family contribution limit, even if the daughter has duplicate coverage. He can carry on and has no risk here. This is confirmed by one of my favorite clauses of Form 969:

Self-only HDHP coverage is an HDHP covering only an eligible individual. Family HDHP coverage is an HDHP covering an eligible individual and at least one other individual whether or not that individual is an eligible individual).

Adult Child with Secondary Insurance

As for the daughter, I don’t think anyone is stopping her from having multiple health insurance plans. And it is true that adult children on their parent’s HSA can open their own HSA. That is a great feature and allows them to contribute a lot.

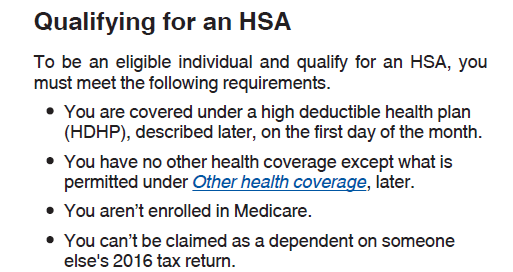

Even if she has HSA eligible insurance, there is a further test. In order to contribute to an HSA, you need to be an eligible individual. Per Form 969:

Notice #2 above. Her “other” coverage, whether it is the primary or secondary, almost certainly does not fall into the exceptions listed in Form 969. Thus, with 2 health insurance plans, she would violate the “Other Health Coverage” provision. She would not be an eligible individual with dual coverage, and would be unable to contribute to the HSA during those months with dual coverage.

Over contribution

Note that contribution limit is pro rata by month. For example, if she enrolls for 3/12 months on 1 insurance plan, she earns 3/12 of the contribution for the year. When she joins that second plan for say the remaining 9/12 months, she doesn’t earn contribution limit for those months. But she would still be able to contribute the 3/12 or 25% of her limit.

If this situation existed in 2018 and she made contributions, she likely over contributed, and has until tax day to remove any excess contributions and get her taxes corrected. If it is a current year situation, she can correct it up until tax day next year.

If she is keen on the HSA I would avoid the 2nd plan.

Note: If you want help calculating your HSA contribution limit and filing your taxes, please consider my service EasyForm8889.com. It asks you simple questions and fills out Form 8889 correctly for you in about 10 minutes.