Overview

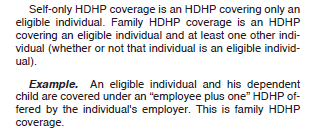

The contribution limit for your Health Savings Account is based on the type of insurance you have, in addition to your age and the tax year. For most people, determining if their insurance coverage is “self-only” or “family” is pretty straightforward: if their insurance plan only covers them, they have “self-only” coverage. On the other hand, if their insurance covers both them and a spouse, child, or dependent, they have “family” coverage. This determination is important for determining both your contribution limit and filling out line 1 on Form 8889.

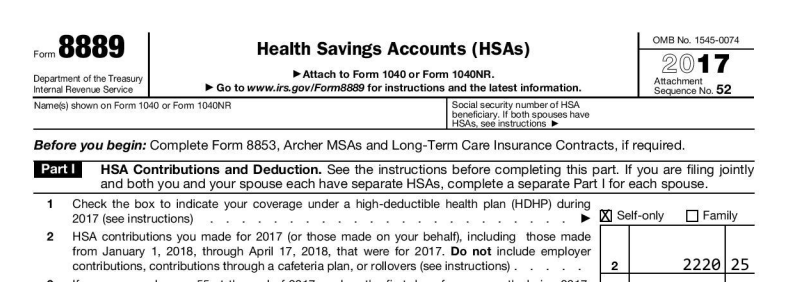

Line 1 of 2017’s Form 8889 marked as “Self-only” provided by EasyForm8889.com.

However, there are some situations where this coverage determination is not so simple. For example:

- Both my spouse and I have individual insurance plans

- I had both self-only and family HSA coverage at the same time

- I had self-only and family coverage at different times during the year

- I had self only coverage for 6 months and family coverage for 6 months

In this article we will review the methodology for determining if your HSA insurance is self-only or family and address each of the scenarios listed above.

Rules to determine your HSA coverage

There are a few rules to follow to determine your HSA coverage type for the year. Form 969 provides blanket guidance with this paragraph:

Note that going forward, coverage type means the “general” coverage you had for the year. This determination is important as it drives the answer to Line 1 on Form 8889 and not necessarily determining your contribution limit (more later). The following rules are listed in order of precedence, with the most important ones first:

- If you had family coverage on December 1st, check the “family” box on Form 8889. This is because, regardless of the number of months covered, you will be eligible for the Last Month Rule at the higher family contribution limit.

- If you had both self-only and family coverage during the year, choose the one that was in effect longest.

- In a given month, if you had both self-only and family HSA coverage, that month counts as “family” coverage. This makes sense because the family coverage has a higher contribution limit. This may apply to you if you are calculating your coverage by month.

Special cases for determining HDHP coverage

We can apply the above rules to the coverage questions posed earlier to help you determine what type of coverage you should mark on Line 1:

1) Both my spouse and I have individual insurance plans

Even if both you and your spouse have separate self-only plans, you cannot “combine” them to be qualified for family coverage. Instead, you both need to open your own HSA and contribute the self-only amount to that respective HSA. You will need to file a separate Form 8889 for each HSA.

2) I had both self-only and family HSA coverage at the same time

Per the Form 8889 instructions, if you are covered by two HSA plans at once, and one of them is family coverage, you are considered family coverage. This may happen if you are transitioning from one plan to another.

3) I had self-only and family coverage at different times during the year

If you had different coverage during the year, your Form 8889 line 1 will be whichever was in effect the longest. So if you had family coverage from January – April, then self-only coverage from May – November, you would be considered “self-only” for the year. Although notice in this scenario that your contribution limit will actually be higher than the self-only contribution limit, on account of your 4 months at the higher family coverage rate.

4) I had self-only coverage for 6 months and family coverage for 6 months

This is really a toss up, but I would mark “Family” since that has the higher contribution limit. Won’t affect your contribution limit calculation but to me it looks cleaner to have “Family” on Line 1 followed by a higher-than-self-only contribution limit further down the page.

5) I have self-only coverage and my son/daughter has separate self-only coverage

This occurs when a parent has HSA coverage (say, through work) but their child (or other dependent) is on another self-only HSA eligible plan. In this case, the parent can only claim self-only coverage since their insurance only has 1 person on it – themselves. They would have to add the child to their insurance to claim Family. However, the child can also claim self-only coverage (and contribute to their own HSA) if they are not a dependent. See the article Your Adult Children Can Open an HSA for more information.

Note: if you need help with Line 1 or any Line in Form 8889, please consider using my service EasyForm8889.com to complete Form 8889. It asks simple questions in a straightforward way and will generate your HSA tax forms in 10 minutes. It is fast and painless, no matter how complicated your HSA situation.