What are Cafeteria Plans

To understand Cafeteria Plans and HSA’s, it helps to understand the mechanisms for contributing funds to your Health Savings Account. There are four different ways to contribute to an HSA, all of which count towards your yearly contribution limit:

- Your employer contributes their money to your HSA. In this case, your employer gifts you funds directly into your Health Savings Account during the tax year. This is by far the best way to fund an HSA since the money is free and being given to you. Employer contributions count towards your yearly contribution limit but they are yours to spend as you like.

- You contribute after tax money to your HSA. This usually occurs by depositing cash or transferring funds between your bank account and your Health Savings Account. You have likely paid taxes on these funds (via payroll) so HSA tax Form 8889 helps you account for them and refund those taxes paid.

- You contribute from your IRA or Roth IRA. This is called a Qualified Funding Distribution and moves money from one tax advantaged investment account to your HSA. Do note that these contributions contain a Testing Period,

requiring you to maintain HSA insurance. - Your employer withholds your earnings pre-tax and contributes them to the HSA. This is an example of a what is called a cafeteria plan. These funds are yours (since they are being paid to you and are no longer your employer’s) and are a part of your paycheck. The employer is just enabling the contribution for you through their payroll system.

Cafeteria Plans are not unique to HSA’s; in fact, it is a general term used to describe pre-tax contributions made by your employer. They can be established for a variety of employee related savings or expenses.

A Cafeteria Plan is a reimbursement plan governed by IRS Section 125 which allows employees to contribute a certain amount of their gross income to a designated account or accounts before taxes are calculated.

Benefits of HSA Cafeteria Plans

There are numerous benefits of cafeteria plans that not only make your life easier, but actually end up saving money. Besides all of the advantages of savings in an HSA, here are some additional benefits that contributing via a Cafeteria Plan provides:

- You pay less taxes. You read this right, Cafeteria Plans reduce the amount of taxes you pay. This is because payroll tax is not the only tax you pay each paycheck. In addition, you pay into other programs such as Medicare, Social Security, and any state taxes that are taken from your earnings. When you file Form 8889 as part of your tax return, you will only be credited for the income tax that was paid. The other taxes stay with Uncle Sam. Using a cafeteria plan allows you to make these contributions before all these payroll taxes hit it, allowing you to keep a larger slice of your earnings.

- Disciplined savings. One of the hardest things about saving is actually putting aside the money to save. There is always something that comes up or something tempting you as a “more fun” use of the money. Saving via a Cafeteria Plan eliminates this because you automate your savings plan and the money is taken pre-tax. It never even hits your checking account as it goes straight to the HSA, preventing you from spending it and making sure you make your contribution.

- Easier transactions. I never had the luxury of a cafeteria plan so each month I had to initiate a transfer to my bank to make the contribution. Having this taken care of for you reduces the amount of work you have to do and transfers you make with your money.

If you are presented the option for contributing to an HSA via cafeteria plan you should definitely consider it, based on the benefits above. Their main drawback is decreased flexibility in changing HSA contributions, since they are happening automatically from your paycheck. For example, it may take time to adjust your HSA contribution amount during the year. There may be a lockout period, a delay before it takes effect, and you at least have to talk to HR to make the change. You should evaluate how your specific payroll plan handles changes to HSA contributions via a cafeteria plan and assess whether that is suitable to your needs before signing up.

Reporting Cafeteria Plan Contributions on Form 8889

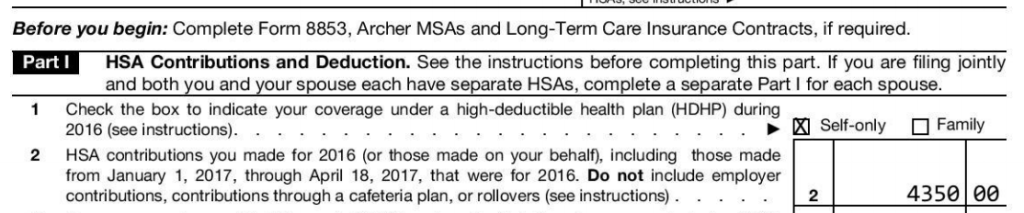

The biggest mistake people make with Cafeteria Plan contributions and filing HSA tax Form 8889 is putting them on Line 2. Line 2 is where contributions you personally made (#2 above) are totaled and used to reduce your taxable income. This has the effect of making your contributions tax free. You can see that by adding Cafeteria Plan contributions to this line, you are “double dipping” because you never paid taxes on those contributions to begin with. Line 2 has a disclaimer that calls this out:

Do not include employer contribuitons, contributions made through a cafeteria plan, or rollovers in Line 2 (see instructions)

Due to the IRS’ confusing wording, most people don’t even know they are contributing through a cafeteria plan or what one is. Thus, they end up making a mistake on Form 8889 and potentially receiving a call from the IRS.

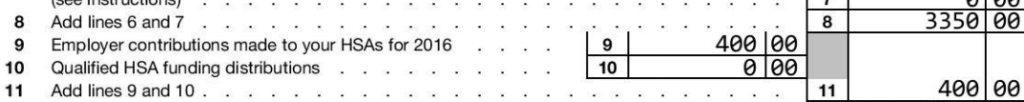

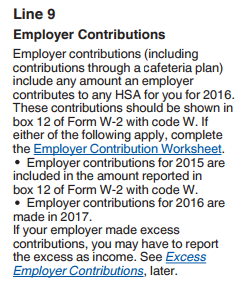

The correct place to put contributions made through a cafeteria plan is on Line 9 of Form 8889, which is called “Employer Contributions”. This makes sense because, in our discussion above, we saw how cafeteria plan contributions look a lot like employer contributions. There is no taxes being paid on both of these contributions, it is just a matter of whose money is being contributed. Again, the IRS doesn’t help us with Form 8889 because they describe the line as “Employer contributions made to your HSA for 2017”.

If you look into the Form 8889 instructions, you can see that this is the exact spot where Cafeteria Plan contributions should go:

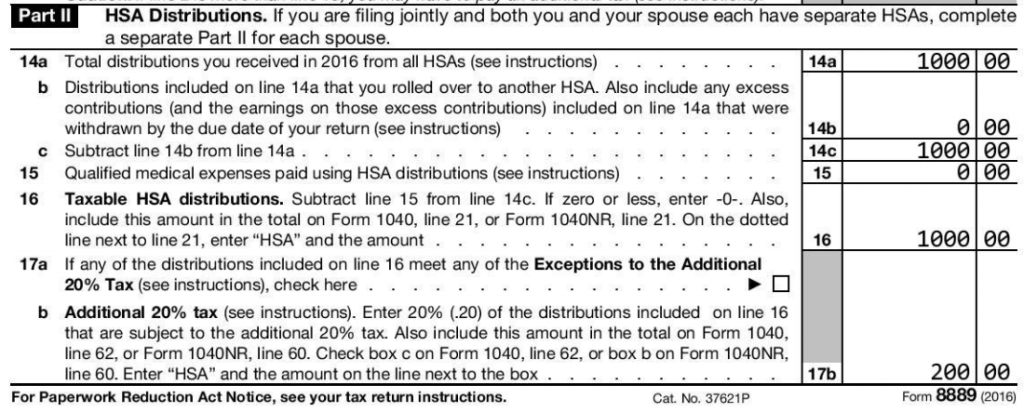

Doing so will ensure the amount that travels over to your 1040 form is the correct amount to deduct.

————————————

Note: if you need help with cafeteria plan contributions on Form 8889, please consider using my service EasyForm8889.com. It asks you simple questions and fills out Form 8889 perfectly for you in about 10 minutes.