At some point you may find yourself with multiple Health Savings Accounts that you wish to combine or transfer money between. While the actual transaction is easy to accomplish, there are potential tax implications per the IRS, as this transaction ends up on Form 8889, so it is best to play by the rules and do it correctly. This article will outline those rules to rollover your HSA.

HSA Rollover Definition

The IRS defines an HSA rollover as:

A rollover is a tax free distribution (withdrawal) of assets from one HSA or Archer MSA that is reinvested in another HSA of the same account beneficiary.

Note they define a rollover as a distribution that occurs in an effort to move money between Health Savings Accounts that belong to the same owner. However, the key word is distribution which we will get to shortly. They go on to say:

Generally, you must complete the rollover within 60 days after you received the distribution.

This language confirms that you are actually receiving the money, probably in the form of a check, from the originating HSA trustee. You then have 60 days per the IRS to deposit that money in a corresponding HSA to avoid penalty. One last rule from the tax man:

An HSA can only receive one rollover contribution during a 1 year period.

The IRS puts a limit on the number of HSA rollovers that can occur during a year, which is not necessarily a calendar year. But they note that this restriction is on the receiving HSA account, not the originating account.

Direct Transfer from HSA to HSA

It is important to note that rollovers that occur directly between HSA trustees are not considered rollovers. For example, if you instruct HSA Account 1 to transfer $500 to HSA Account 2, and they transfer directly without you ever seeing it, this is not a rollover. Instead, the IRS deems this a transfer:

If you instruct the trustee of your HSA to transfer funds directly to the trustee of another of your HSAs, the transfer is not considered a rollover. There is no limit on the number of these transfers. Do not include the amount transferred in income, deduct it as a contribution, or include it as a distribution on Form 8889.

Thus, the same rules do not apply to transfers and HSA rollovers. Transfers are much more flexible and frequent. Likely, the IRS imposes tight rules on Rollovers since they “lose sight” of the money for a while, which opens the door for non qualified HSA spending. The key test is in the distribution, determined by whether you physically receive the HSA funds (check) to redeposit in another HSA.

HSA Rollover vs Transfer Comparison

This table clarifies the difference between HSA rollovers and transfers:

| Rollover | Transfer | |

| Funds transferred | to you, then to receiving HSA | directly to receiving HSA |

| Time to complete | 60 days | None (instant) |

| Form 8889 impact | Include in 14a and 14b | Not included |

| Frequency Limits | Once every 12 months | No limit |

| Affects HSA Contribution Limit | No | No |

| Included in income | No | No |

| Deductible | No | No |

| Difficulty | medium | easy |

HSA rollover rules

To summarize the rules for rolling over your HSA:

- Initiate the distribution from your originating HSA trustee, and they will send you a check

- Upon receiving the HSA funds, redeposit them with the receiving HSA trustee within 60 days

- You may only make one rollover during each 1 year period, beginning on the date you make the deposit.

- Record this as an HSA rollover on Form 8889, lines 14a and 14b.

Should I transfer or rollover my HSA?

In general, I would opt for a direct transfer of your HSA. This is done by instructing your HSA trustee to move money to another HSA trustee. The reason is it is much simpler for you to execute and takes less time. You don’t have to wait for the check, spend time depositing it in your other HSA, and then remember and figure out how to report it at tax time on HSA Form 8889. Plus, you can do as many of these transactions as you wish during the year.

How to report HSA rollover to the IRS

One disadvantage of a true HSA rollover is that you will need to report it on IRS tax Form 8889. When properly accounted, a rollover will not adversely affect you in terms of taxes, penalty, or contribution limit; it is a totally legitimate transaction. Instead, it is more of a nuisance as you have to remember to report it to satisfy the IRS and correctly file Form 8889.

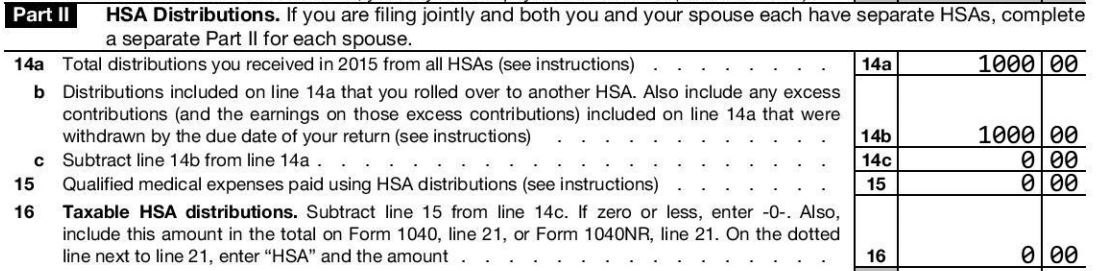

On Form 8889, you will need to include the amount of your HSA rollver distribution on both:

- Line 14a – Total distributions you received from all HSA’s

- Line 14b – Distribution included on line 14a that you rolled over to another HSA.

Here is an example of what Form 8889 looks like for 2015 with only a $1000 HSA Rollover:

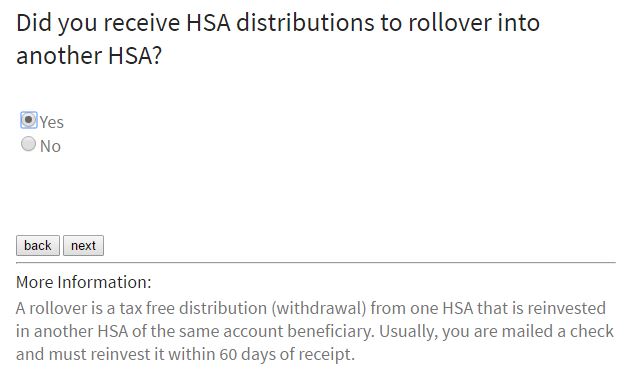

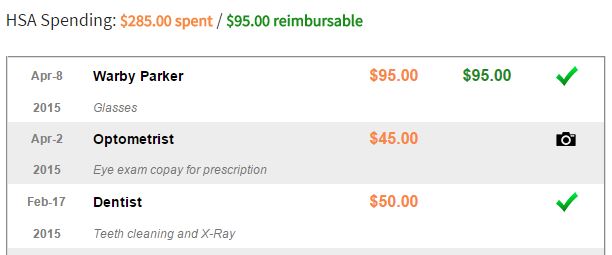

The above was prepared by EasyForm8889.com, which asks simple questions like this to complete HSA Form 8889:

Transfer your HSA to a New Employer

Depending on how your employer’s HSA is setup, there may not be any work to transfer your HSA to a new employer. In one situation, you go to a new employer who offers HSA eligible insurance, but does not contribute or offer cafeteria plan (removed from your paycheck) contributions. In that case, you manage the HSA yourself, and can maintain the account at whatever financial institution you wish.

However, if your employer is making contributions or your contributions will be made through a cafeteria plan, you may need to transfer funds to your new HSA. You have the option of receiving and redepositing (Rollover) the HSA funds, or just initiating a trustee to trustee transfer for the HSA funds. Either one will work, but note the advantages above of the simpler transfer method. Generally, this will be a good idea to minimize your account fees and manage your HSA in one spot.

HSA rollover IRA to HSA

If you wish to rollover IRA (or even 401(k)) funds to your HSA, this is not considered a rollover, but instead a Qualified HSA Funding Distribution. Please see the aforementioned article for more information, as there are more restrictions and rules regarding this type of transfer.

————————————

Note: if you have an HSA, please consider using my service EasyForm8889.com to complete Form 8889. It is fast and painless, no matter how complicated your HSA situation.