Update: I have finished and launched EasyForm8889.com, an online service to quickly and easily complete tax Form 8889 for your HSA. No matter your situation, it asks you simple questions and generates your completed Form 8889 PDF in less than 10 minutes. Try it today.

Two confusing concepts for Health Savings Accounts are the Last Month Rule and the Testing Period. Both of these help determine your contribution limit to your HSA during the year you first sign up for health insurance as an eligible individual. (Note: If you are filing HSA tax Form 8889 and are on Line 18 that says “Last Month Rule”, this only needs to be filled out if you failed the testing period and owe a penalty; read on. Otherwise, it is $0

I have created the following video to explain the Last Month Rule and Testing Period. Check it out, otherwise, the transcription of the information is below.

Watch on Youtube: HSA Last Month Rule and Testing Period

The Last Month Rule

The Last Month Rule states that if you are covered by an HSA eligible health plan on the first day of the last month of a given year, you are considered an eligible individual for the entire year. This gives you the option to contribute the entire year’s contribution limit to your HSA, which is more than you would be allowed otherwise (pro rata by month).

If you are covered by an HSA eligible health plan on 12/1 of a given year, you can contribute (and deduct) the full year’s contribution limit.

For example, you could begin HSA coverage in November of a given year. Come December 1st, you are covered and per the Last Month Rule, are considered an eligible employee for that full year. That allows you to contribute up to that year’s contribution limit, if you want, even waiting a few months to make a prior year contribution. Back up the truck and load up the HSA!

However, the Last Month Rule is a powerful tool that does bear risk and further responsibility.

The Testing Period

The Testing Period states that if you use the Last Month Rule, you must remain an eligible individual (covered by HDHP) for the next 12 months, so through December 1st of the following year. If you fail to remain an eligible individual (change insurance plans, lose insurance plan, receive other health coverage) during that time, any “excess” contributions you made as a result of using the Last Month Rule will be taxed and penalized.

If you contribute per the Last Month Rule and end your HDHP insurance before the Testing Period ends, excess contributions will be taxed and incur a 10% penalty.

In this case, “excess” contribution are amounts you contributed in violation of the Testing Period. Said another way, you contributed more based on the Last Month Rule, and the Testing Period required you to maintain HSA eligible insurance for one year. You did not fulfill this year, and you will have to subsequently recalculate what your contribution limit would have been and pay taxes / penalty on the difference. You can see this on the Form 8889 Instructions in Section 3, Line 18.

Calculating Last Month Rule Penalty

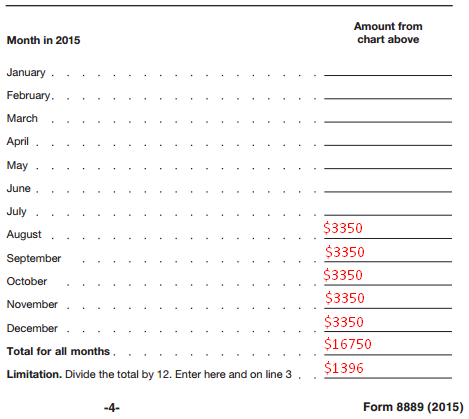

Using the Form 8889 Instructions, use the Line 3 Limitation Chart and Worksheet to calculate what your actual contribution limit was for the prior year, not using the Last Month Rule. For example, if you started HSA eligible insurance on August 1st, you would fill out (yearly) contribution limits for August, September, October, November, and December, then divide by 12. This number ($1396), your allowable contribution limit, will be compared to the contributions you made via the Last Month Rule.

Likely, you previously contributed more than you were allowed. The difference is your excess contribution resulting from failing the Testing Period, and this line will be entered on Line 18 of Form 8889. This excess contribution amount invokes a penalty for violating the last month rule in both 1) tax (your marginal tax rate, say 25%) + 2) penalty (10%). This flows through back to your taxes by 1) adding back this income to your taxable income and 2) assessing an additional penalty in Section 3 of Form 8889.

Testing Period Examples

Here are some examples to demonstrate how the Testing Period works:

Example 1 – no problem

Paul is covered by an HSA family insurance on December 1st. He is able to take advantage of the Last Month Rule and does, contributing the maximum to his HSA for that year even though he only had coverage for one month. He does not change plans for many years so passes the Testing Period, which lasted until 12/1 of the following year.

- Contribution made = $6,650

- Allowable contribution = $6,650 (fulfilled Testing Period)

- Excess Contribution = $0

Example 2 – coverage type problem

George was covered by single HSA coverage from January – November, but on December 1st changed to family plan HSA coverage. Using the Last Month Rule, he contributed the full family amount for the year ($6,650) to his HSA. However, he ended his HSA eligible insurance in November of the following year, meaning he failed the Testing Period at its end on the following December 1st.

- Contribution made = $6,650

- Allowable contribution = $3,625 (11 months single; 1 month family)

- Excess Contribution = $3,025

- Taxes due = $756 ($3,025 x 0.25 tax rate)

- Penalty = $303 ($3,025 x 0.1 penalty rate)

Example 3 – ending coverage problem

John is covered by a single HSA eligible insurance plan on December 1st. He is able to take advantage of the Last Month Rule and does, contributing the maximum to his HSA for that year even though he only had coverage for one month. He continues making monthly average contributions (contribution limit / 12) for 6 months until June 30th, when he switches jobs and no longer has HSA insurance. As a result, he is no longer an eligible individual during his Testing Period. He has made 18 monthly average contributions during 7 eligible months, so he now needs to declare 11 of those as income during the year and pay a 10% tax on that amount. His calculations are:

- Contribution made = $3,350

- Allowable contribution = $279 ($3,350 * 1/12)

- Excess Contribution = $3,071

- Taxes due = $768 ($3,071 x 0.25 tax rate)

- Penalty = $307 ($3,071 x 0.1 penalty rate)

Effects of the Last Month Rule / Testing Period

In the above examples, the account holders were taking a calculated risk that they could satisfy the Testing Period of the following year. You can see the tax/penalty is substantial for failing it. Thus, while powerful, the Last Month Rule can be a double edged sword. Some effects are:

- + Can make full year contributions during years of partial coverage

- + Jump start contributions to your HSA

- + Can reduce your taxes in the year you sign up for an HSA

- – Risk over contributing and invoking taxation + 10% penalty

Determine your risk

When making a decision about a Last Month Rule situation, consider the following which may negatively affect you during the Testing Period :

- How likely are you to change jobs during the Testing Period? Will your future employer offer HSA plans

- How likely are you to change plans during the year, do to changes in status or partner’s plan?

- How likely is your employer to change your health insurance options during the Testing Period?

Perhaps the safest strategy is waiting until the following year (but prior to April 15th) to make a Prior Year Contribution. This ensures you do not over contribute during a period and have to declare and pay tax on an amount. The strategy here is to save monthly amounts in a non-HSA account, and after the fiscal year (but before April 15th), contribute the money to your HSA as a prior year contribution.

————————————

Note: if you are having trouble with the Last Month Rule, please consider using my service EasyForm8889.com to complete Form 8889. It is fast and painless, and asks simple questions no matter how complicated your HSA situation.