When searching for health insurance plans, it can be difficult to understand exactly what you are getting. Besides the medical jargon, there are a host of acronyms that aren’t clearly defined. These combine to make this important decision all the more difficult.

Before evaluating specific plans, broadly consider your finances and medical situation to determine your needs and constraints. What is your goal with coverage? What is your budget for health insurance per month? How much of a deductible can you handle each year? How strong is your emergency fund? Do you have any medical conditions that require frequent visits? Do you have a family doctor that you would like to continue visiting?

HMO vs. PPO – Understand the Plan’s Network

An insurer has a unique network of doctors, care centers and hospitals that you can visit. This is considered in-network care and is significantly cheaper than any other alternative. Basically, you want to receive care in-network if possible. Out of network care exists outside of this realm and is generally more expensive.

The best way to evaluate the insurer’s network – and how it fits your location and needs – is through their website. You can see what offices are close by and how extensive the coverage is.

This is a good time for a primer on HMO’s vs. PPO’s. Health Maintenance Organizations (HMO’s) generally assign a designated primary care physician who you visit first. That physician then directs your care and schedules other services as needed, most likely in-network. With HMO’s there may be no deductible for in-network care but monthly premiums are generally the highest. HMO networks are smaller and more local so choices may be limited. However, the care is coordinated and the costs for procedures may be lower.

Preferred Provider Organizations (PPO’s) have a vast network of preferred medical providers who you can visit. Generally, they will require a copay for each visit and any additional costs will be at a very favorable rate as you are in network. Moreover, if you venture out of network, your PPO may reimburse you for a percentage of those costs. Unlike an HMO, no referral is needed before seeing a specialist, which allows for more flexibility in this type of plan.

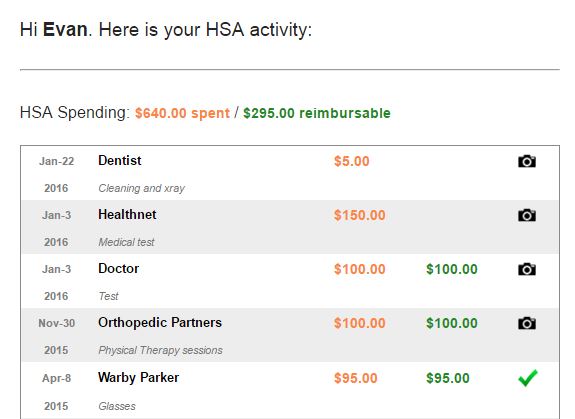

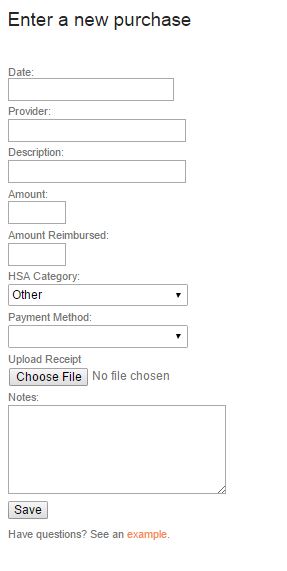

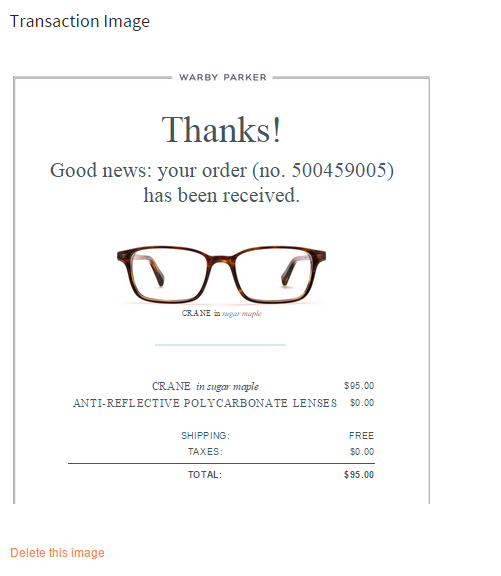

A Health Savings Account is separate from a PPO or HMO; it is merely a qualifier that lets you open the tax advantaged savings account. Thus, you may have an HSA with either an HMO or PPO.

Evaluating Plan Characteristics

Below is a run down of the main qualifications you will encounter in choosing a health insurance plan. While certain factors weigh more heavily, it is the mix – combined with your health care needs – that enables you to choose the best plan for you.

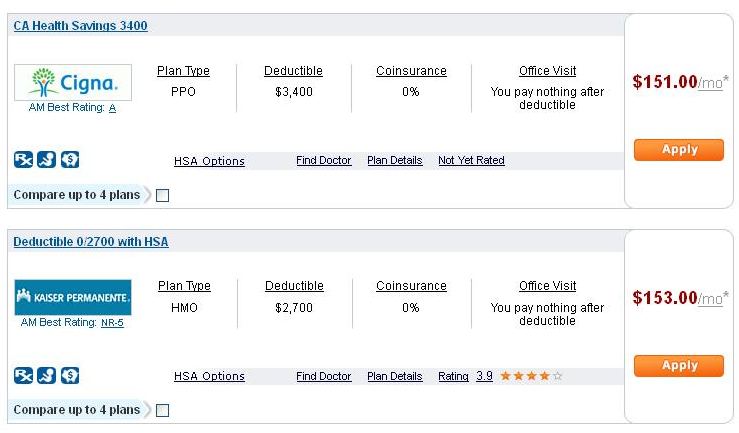

Here is what it looks like comparing quotes on eHealthInsurance.com:

Explanations:

- Premium – the amount you pay each month to maintain your insurance. This amount is paid regardless of services received.

- Deductible – the amount you must pay before the provider pays for any services. Note that during this time, you pay favorable, reduced rates for in-network care. After incurring costs equal to your deductible, your provider will pay part (coinsurance) or all of the additional charges.

- Coinsurance – a % of charges you must pay after the deductible kicks in, but before our OOP max. Think of it as a reduced rate for coverage in this range – neither party is paying 100%. Prior to reaching your deductible, you paid 100% of the charges. After surpassing your out of pocket max, your insurance pays 100%. In between, you both pay coinsurance, which is quoted in terms of your share.

- Out of Pocket (OOP) Max – your maximum financial liability for the year. Note that this does not include monthly premiums. Generally, one will reach their OOP max by incurring charges over their deductible and straight past their coinsurance period (if any). Your OOP max may also called the co-pay max.

- Office Visit – how much an office visit to an in-network doctor will cost. Sometimes, there is no benefit; you simply pay what the provider charges.

- Co-Pay – the amount that you must pay out of pocket when purchasing services (visit) or prescription drugs.

Hopefully this makes plan selection easier for you. Drop me an email or leave a comment if you have any questions.