A Health Savings Account (HSA) is tax advantaged savings account for medical expenses. You can open one if you are insured by a qualified High Deductible Health Plan (HDHP).

Basically, it is your own bank account designated for medical expenses.

Your HSA is a personal savings and investment account that you own forever. Even if you change health insurance plans or quit your job, it is yours until you spend it. Unlike other health care plans, it does not ‘reset’ or go away at the end of the year. This account can be used to pay for a wide variety of medical costs that include your plan’s deductible, doctor’s visits, co pays, prescriptions, dental / vision, and some household medical items.

There are important tax advantages to an HSA account that make it very attractive. Notably, the contributions, growth, and qualified withdrawals all occur tax free. This is called the Triple Tax Advantage. As long as you follow the rules, you can effectively pay for your medical expenses (besides premiums) using tax-free dollars. This is a huge economic benefit.

You can invest your HSA in a manner similar to retirement accounts. This allows your savings to compound and grow over time. Investment options span from interest bearing savings accounts to bonds, stocks, ETF’s, and mutual funds. This is a great option if you have a long time horizon, as you can accumulate a great deal of savings.

After age 65, you can withdraw from your HSA without penalty and use the money for anything. You just need to pay income tax on the distribution. Thus, an HSA is a form of retirement savings.

Each year there is a contribution limit for how much you can save in your HSA. You may decide to fully fund your HSA at the start of the year or contribute some money each month (I currently contribute $160 per month). During some months, medical expenses may arise, requiring you to spend some of your health savings account. For example, you visit the doctor, which costs you $45. With ‘regular’ insurance plans, you would only have to pay a $25 copay out of pocket.

While $45 is certainly more than $25, remember that you have been saving every month as the monthly premiums are lower. Ideally, you can pour those “savings” into your HSA account. In that way, you shift part of your health care spending from a monthly expense (never see it again) to a lifelong asset (you own it forever).

A Few Qualifiers

To open an HSA, you:

- Must be covered by an HSA qualified HDHP (see below)

- Cannot be claimed as a dependent on someone’s tax return

- Cannot have any other health care coverage

- Cannot be enrolled in Medicare

First, you need an HDHP

High Deductible Health Plans (HDHP) are a category of insurance plans available from your health insurance provider. Key characteristics of HDHP’s are:

- Lower monthly premium than similar plans

- A higher yearly deductible than similar plans

- An out-of-pocket maximum that limits your yearly financial liability

HDHP policies have a yearly deductible of $1,200 or higher. This deductible must be paid before insurance coverage kicks in. At the same time, your monthly premiums can be much lower than regular insurance. Think of it similar to your car insurance – a conveniently low deductible requires higher monthly premiums. Financially, it often makes sense to have a higher deductible and pay lower monthly premiums. This is due to the infrequent need to pay the deductible. After some period of time, the savings from having a lower monthly premium add up to more than the difference in deductible. And these savings keep accruing, month after month.

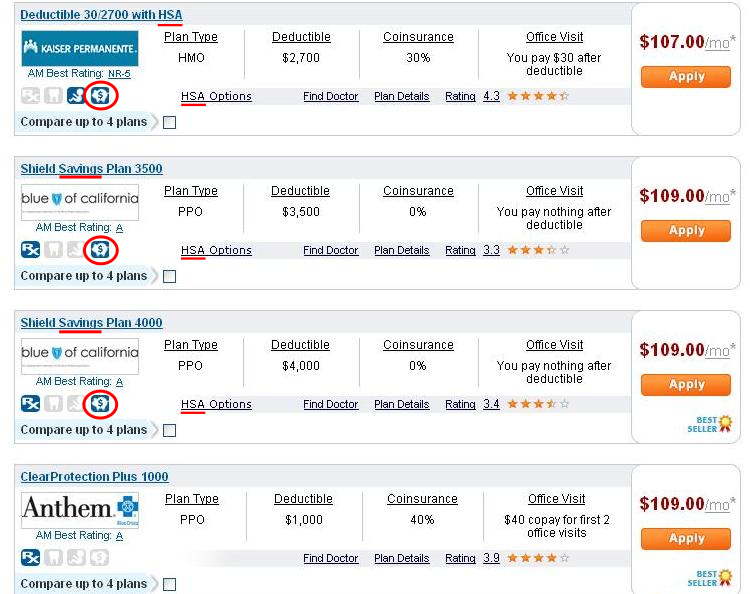

HSA eligible policies are fairly easy to spot. Often times when comparing policies, you will see an icon or text that says “HSA Eligible”. This lets you know that your plan is a qualified HDHP.

You can see how this is presented on plans from ehealthinsurance.com:

As soon as you your HDHP coverage begins, you can open and fund your HSA account. It takes but minutes as there is not much paperwork required. From there, you are on your way to controlling your health care and saving for your future.