Overview

Did you know that if your adult children are covered by your HSA eligible family health insurance, they likely can open their own HSA? You read that correctly. A common misconception is that only the policy holder can open a Health Savings Account. This is not true, as a review of the HSA guidelines reveals that this restriction to the policy holder (read: you) does not exist. Said another way:

Every independent (tax) person on an HSA Family Plan can open their own HSA and contribute the full year amount.

With the (un)Affordable Care Act mandating that children be allowed to remain on parent HSA insurance plans until age 26, more and more adult children are opting for this and staying on parent plans longer. The good news is, if they are no longer your tax dependent, they can open their own HSA, and anyone can contribute to another’s HSA account. That means that even if junior is in university and making no money, he can still receive up to $6,750 into his HSA account for 2015 from his loving mom or dad, or grandparent, or whoever.

The mechanics of your child having an HSA

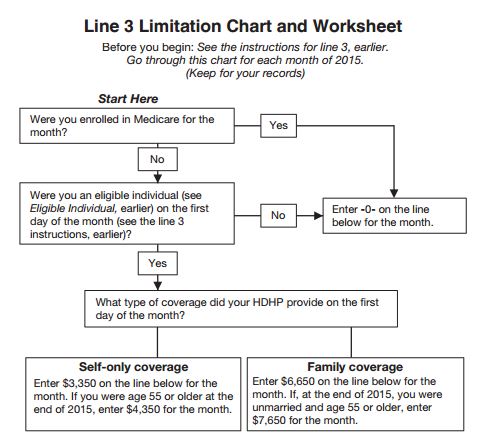

So how does this work? The mechanics lie within the definition of and eligible individual, or who can open an HSA, provided by friendly Publication 969. An eligible individual is defined as one who:

- is covered under a High Deductible Health Plan (HDHP)

- has no other health insurance

- is not enrolled in Medicare

- cannot be claimed as a dependent on someone else’s tax return (important)

The key one is really #4, in that an HSA holder cannot be claimed as a dependent on someone else’s tax return. Unfortunately, due to this you cannot open an HSA for your young child or children and begin saving for them. You have to wait until they are filing their own taxes. Other than that, the first 3 should almost always apply to adult children. If all 4 of these are true, your adult child qualified as an eligible individual even though they are on your health insurance. That means they can open their own Health Savings Account and begin saving – or you can begin saving for them.

Child HSA Example – Simple

Let’s assume that you are married and have one child who is not longer your dependent. To keep things simple, assume you have had HSA eligible family insurance for everyone for a while (so no Last Month Rule effects) and you are smart and have your own HSA, but your spouse does not. For 2016, the contribution limit for family insurance is $6,750. As such the following maximum HSA contributions are allowed:

- You – $6,750

- Child – $6,750

Note that the above amounts end up in 2 different Health Savings Accounts – one for you, and one for your adult child.

Children HSA Example – Complicated

Now assume that you are married and have two adult children and everyone is on your HSA eligible family insurance. Let’s assume you began that insurance on July 1st (exactly mid year) so the Last Month Rule is eligible for this year. Both you and your wife are smart and have your own separate HSA’s, and thus due to Line 6 of Form 8889 you must share the maximum contribution amount between these two accounts. Note that this does not affect your children. For 2016, the contribution limit for family insurance is $6,750. As such the following maximum HSA contributions are allowed:

- You & spouse – contributions to both HSA accounts cannot exceed $6,750

- Child 1 – $6,750

- Child 2 – $6,750

A couple things of note. You and your spouse are limited to a $6,750 between your accounts (so $3,375/$3,375, or $6,750 / $0 would both work). Also notice that your children can each contribute up to the family contribution limit, separate from you and your spouse’s limitation. This is the big advantage here.

An important note: it is my duty to explain the Last Month Rule here. Since coverage began in July, you are freely allowed to contribute 6/12 x $6,750 = $3,375 for the year for each of these accounts. However, you have the option to use the Last Month Rule and contribute the full $6,750 to each account, but you must maintain coverage for the following year. Otherwise, any amount over contributed to each account can be taxed and penalized.

Reasons to establish Health Savings Accounts for your children

There are a wide number or reasons to establish and contribute to an HSA for your adult children. Children at this age (18-26) are just beginning to understand and manage their finances and establishing good habits can last a lifetime. Additionally, due to the nature of US healthcare you want to offer them every advantage they can get. Having a pile of cash to fall back on for medical care as they go through their 20’s can provide peace of mind as well as incentive to actually go and visit the doctor if something is wrong. It helps remove the money problem from medical decisions. In some ways, it is analogous to opening an IRA for them and contributing, but arguably, more practical.

Here are some additional advantages:

- Emphasize importance of saving

- Teach them the value of money and how to navigate US healthcare system

- Encourage them to manage their finances wisely

- Provide a financial safety net as they begin their career

- Allow them to pay for healthcare as it arises

- Contributions provide a tax deduction on Form 8889

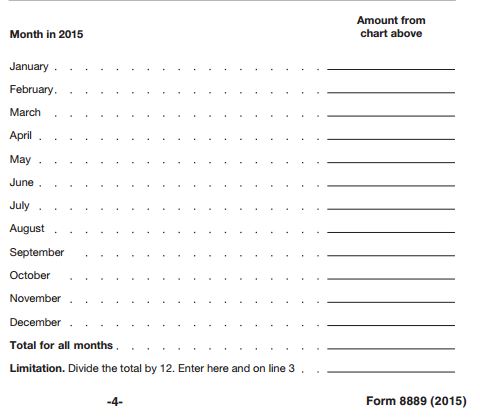

That’s a lot of Filing Form 8889

One thing of note, is that you must file a Form 8889 for every HSA account that receives contributions or spends money, every year. That means that everyone with an HSA – you, your wife, any children – all need to fill out this tax form when filing you taxes each year. Being children, and new to taxes and HSA’s, they are prone to avoid or miss this requirement and incur financial penalty. Help them avoid this by explaining tax requirements; you can even see an article on how to file Form 8889.