Note: if you are struggling with the Qualified HSA Funding Distribution on Form 8889, please consider using my service EasyForm8889.com. It asks simple questions and will complete Form 8889 for you faster than you can read this article.

Fund your HSA with your IRA

Besides all of the other benefits of HSA’s, the folks at the IRS have included a provision that allows you to fund your Health Savings Account from your traditional IRA or Roth IRA. This is called a Qualified HSA Funding Distribution and it allows you to contribute your yearly HSA contribution limit from your IRA. The IRS limits this activity to occur once in your lifetime but you will see that, in fact, you can make up to two qualified funding distributions in your lifetime. Additionally, there are some restrictions on how you make the transfer and that you maintain coverage after the transfer (called the Testing Period). We will give you the details and help you avoid taxes and penalties when making an HSA contribution from your IRA.

What types of IRA’s are allowed for Qualified Funding Distributions?

First of all, you have to have an individual retirement account (IRA) with some funds in it to contribute to your HSA. The IRS stipulates that your IRA be a traditional IRA or Roth IRA. They do not allow that an “ongoing” IRA be used for Qualified Funding Distributions, so this excludes ongoing SEP IRA’s (generally self employed) or SIMPLE IRA’s (cousin of the 401(k)). The IRS considers “ongoing” IRA’s to be those where an employer has made a contribution within the tax year that the HSA funding distribution would occur. Whether your plan is “ongoing” or “inactive”, and if you can contribute, is beyond the scope of this discussion but may be worth researching.

How much can I contribute to my HSA from my IRA?

The amount that you can contribute from your IRA to your HSA depends on your HSA coverage, your age, and the tax year. The quick rule is you can only contribute up to your maximum HSA contribution limit for the tax year in question. This isn’t a way to get extra money into your HSA, just a way you can fund it from an established source. So for 2017 here are some examples for the maximum contribution from your IRA to Health Savings Account:

| Your insurance |

HSA Contribution Limit

(2017) |

Qualified Funding Distribution Limit (2017) |

| Self Only |

$3,400 |

$3,400 |

| Self Only, 55+ |

$4,400 |

$4,400 |

| Family |

$6,750 |

$6,750 |

| Family, 55+ |

$7,750 |

$7,750 |

Note that this amount is determined using 1) the HDHP coverage you have at the beginning of the month that the Qualified HSA Funding Distribution occurs, and 2) the your age at the end of the tax year.

When can I make a Qualified HSA Funding Distribution?

The IRS has ruled that you may transfer from your IRA/Roth IRA to your HSA once during your lifetime. This isn’t once per year, this is one and done. So if you are going to contribute from your individual retirement account, make it count. Use this information to plan and don’t make the mistake of funding too little, because you won’t get another chance.

However, like all good rules, there is one exception. If you make a Qualified HSA Funding Distribution while on Self-Only coverage, you may make an additional Qualified HSA Funding Distribution during the same year if your coverage changes to Family. This allows you to “step up” your contribution amount and in theory rollover a considerably higher amount of money from your IRA. And when you add the 55+ additional catch up contribution, this can be large. If you are over 55, this amount goes from $4,400 to $7,750, a significant increase. However, the IRS is explicit that this must happen in the same year, so it would require a significant event / lack of planning to occur, but hopefully it is useful for someone.

How to actually make the HSA contribution + tax effects

The IRS requires that any qualified funding distribution be made in a trustee to trustee transfer. This means that your IRA trustee (bank) must transfer the money directly to your HSA trustee (bank), without sending you a check. This prevents the money from going “missing” or being spent on non qualified medical expenses. It also prevents any time delays where the money is out of the system. Thus, to actually make the contribution you will have to log in to (or visit) your IRA bank and setup your HSA bank as a related account. You will then need to transfer the money directly to the HSA account, not to yourself. If the option is given, categorize each transaction (both the out and in) as an HSA Qualified Funding Distribution with your bank. This will allow you to remember exactly what happened and potentially avoid IRS warning signs on un-taxed IRA distributions / excessive HSA contributions. Either way, this amount will be indicated as a qualified funding distribution when you file Form 8889 that year.

If done properly, a qualified funding distribution is not included in your income, not tax deductible, and reduces the amount you can contribute to your HSA. This makes sense since because, in order, 1) you don’t need to pay taxes on this money, 2) you already took the tax deduction so you can’t double dip, and 3) it is an HSA contribution so you are prevented from contributing excess.

All in all these are pretty reasonable requirements and provide great flexibility to move money from an IRA to your HSA. However…

The Testing Period

HSA Funding Distributions have a Testing Period that requires that you maintain coverage after making the contributions. For those of you familiar with the Last Month Rule and its Testing Period, the concept is similar. If you make a Qualified Funding Distribution to your HSA you must maintain HSA eligible insurance for just over 1 year after the distribution is made. The IRS defines the Testing Period in Publication 969 (PDF) as:

The testing period begins with the month in which the qualified HSA funding distribution is contributed and ends on the last day of the 12th month following that month.

So the Testing Period lasts for twelve months but through the end of that 12th month of the following year. As an example, if you make a qualified HSA funding distribution on April 1st of 2017, you must maintain HSA eligible coverage through April 30th, 2018. If you make more than one Qualified Funding Distribution by means of different coverage (self-only vs family), each distribution has its own Testing Period.

Failing the Testing Period

Unfortunately, the IRS levies hefty taxes and penalties if you fail the aforementioned Testing Period during the subsequent 12 calendar months. If for any reason you are no longer an eligible individual during that time, your previous Qualified Funding Distribution is:

- Included in income (taxed)

- Assessed a 10% penalty

So very stiff taxes and penalties for failing the Testing Period. Your previously tax free IRA contribution becomes taxed and, to top it off, a 10% penalty is levied. Again, per IRS Publication 969, the penalty for violating the Qualified Funding Distribution Testing Period is:

If you fail to remain an eligible individual during the testing period, other than because of death or becoming disabled, you will have to include in income the qualified HSA funding distribution. You include this amount in income in the year in which you fail to be an eligible individual. This amount is also subject to a 10% additional tax.

This is a bit onerous of a restriction and one that is not to be taken lightly, as it carries quite a significant penalty. The key metric for determining failure is failure to remain an eligible individual. This means that you:

1) You must be covered under a high deductible health plan (HDHP) on the first day of the month

2) You have no other health coverage (see exceptions), you are not enrolled in Medicare, you cannot be claimed as a dependent

Thus, if you are thinking about changing insurance, thinking about a job change, or have a reasonable chance of losing your current health insurance, you will want to carefully consider taking the risk of making the Funding Distribution. In the following section you will see how to report this amount on HSA Form 8889 as well as how to account for taxes and penalties owed from

How to contribute to an HSA from a 401(k)

Notice that there has not been much talk about funding your HSA from your 401(k). This is because a 401(k) is an employer controlled plan and considered “ongoing” by the IRS. Thus, you cannot contribute directly to your HSA from a 401(k). But, there is an easy way to get around this, which is first converting your 401(k) into an IRA. Once that occurs, the account is out of your employer’s control and you are free to make the Qualified HSA Funding Distribution. You will want to be careful to do this by the book and avoid any taxes, but this should be easy enough to do to get funds from your 401(k) into your Health Savings Account.

Qualified HSA Funding Distributions on Form 8889

You will see the words “Qualified HSA Funding Distribution” in two places on HSA tax Form 8889. The first occurs on line 10 and records current year funding distributions made from your IRA. This is the most frequently used line and will reduce the amount you can contribute to your HSA for the year:

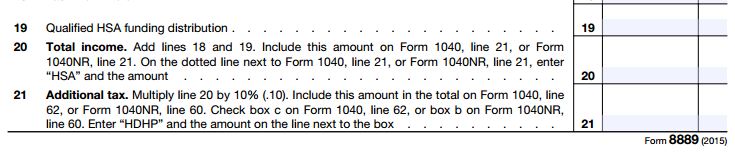

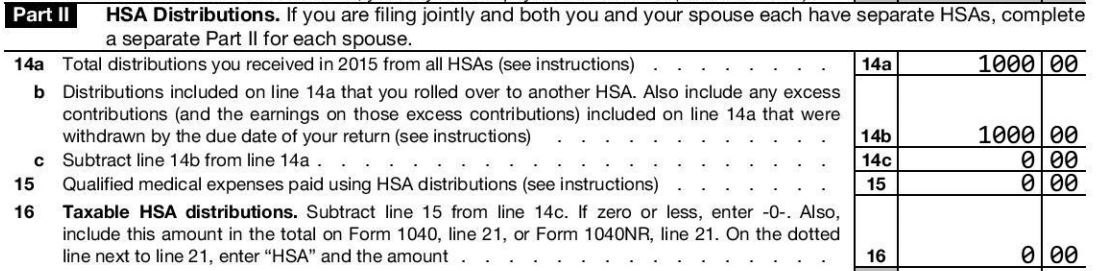

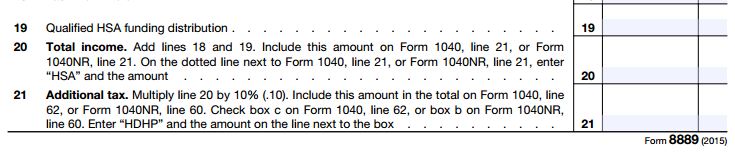

The second instance of “Qualified HSA Funding Distribution” occurs on Line 19. For most people, this will be $0. However, for those that previously contributed to their HSA from their IRA and failed the Testing Period, they will need to make an entry here that is equal to the entire amount of their HSA Funding Distribution. This amount will be flow through to Line 20 where it is taxed and Line 21 where it is penalized:

————————————

Note: if you have an HSA, please consider using my service EasyForm8889.com to complete Form 8889. It is fast and painless, no matter how complicated your HSA situation.