“I have a complicated situation, what is my HSA contribution limit for the year?”

I get this question quite a bit from readers, and it is a great question. At some point during the prior year, your plan / coverage / eligibility changed (possibly multiple times), and all the IRS says regarding the contribution limit is “$3,xxx for Single, $6,xxx for Family”. Not a lot of detail there. However, being good indentured servants taxpayers, we want to fill out our taxes correctly and avoid an audit, so let’s discuss how to determine your Health Savings Account contribution limit when you had insurance changes throughout the year.

The situations manifest themselves in a variety of ways:

- I began HSA eligible coverage this year, what is my contribution limit?

- I ended HSA eligible coverage this year, what is my contribution limit?

- I had gaps in my HSA eligible coverage this year, what is my contribution limit?

- My health insurance changed throughout the year, from single to family, what is my HSA contribution limit?

Spoiler Alert: You will see that situation #1 can employ the Last Month Rule / Testing Period, while the other 3 use a weighted average by month to determine total contribution limit. Read on.

#1: I began HSA eligible coverage this year, what is my contribution limit?

We know that there are single/family contribution limits for an HSA (2016: $3350/$6750), but what happens if you begin new HSA eligible insurance mid year? Do you get a partial contribution limit, a full contribution limit, or how do you calculate it? Well, the Last Month Rule, a part of the IRS tax guidelines, governs this. It basically says:

If you are covered by an HDHP on Dec 1st of a given year, you may contribute the maximum for that year.

However, there is a catch. In order for you not to take advantage of the system, if you take advantage of the Last Month Rule you are subject to the Testing Period. The Testing Period states:

If you contribute per the Last Month Rule and end your HDHP insurance within 1 year, you will have to pay tax on any excess contributions you were allowed to make and pay a 10% penalty.

Thus, you want to be very certain that you plan on maintaining HSA coverage for 1 full year if you take full advantage of the Last Month Rule. Otherwise, you will fail the Testing Period when you file next year’s taxes and the government, assuming you are taking advantage of the system, will penalize you for excess contributions (on a pro rata scale based on time you lost coverage). You can always choose to hedge your bet and contribute a fraction, say 50%, which would entail a 6 month Testing Period.

#2: I ended HSA eligible coverage this year, what is my contribution limit?

If you changed insurance or otherwise ended your HSA eligible insurance during the year, you can still contribute to your HSA for those months that you had HSA coverage. For example, if you had a family HSA and had coverage for 6 months, your contribution limit for 2016 would be $6,750 x 6/12 = $3,375. This means that you still reap the benefits of the HSA contribution, even though you have left the plan. In the prior example, if you had HSA insurance from January 1st – July 30th 2015 (6 months), you have up until tax day of the following year to contribute to your HSA. In this case, April 15th, 2016.

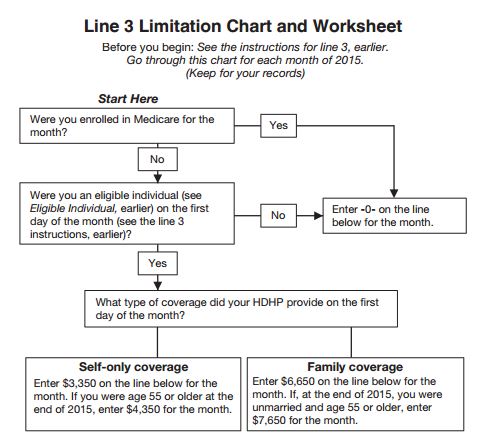

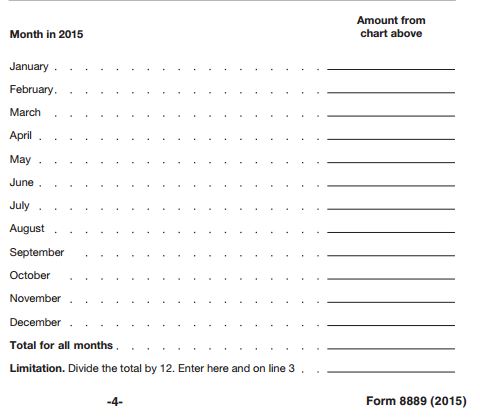

This contribution limit is verified by looking at the details of how Line 3 Limitation Chart and Worksheet determines your contribution limit on your HSA tax form, Form 8889:

This part determines your monthly contribution limit for 2015

The second part performs the monthly average, summing and then dividing by 12

Based on the above chart, you can see how any combination of insurance timing and coverage can lead to your yearly contribution limit.

#3: I had gaps in my HSA eligible coverage this year, what is my contribution limit?

No problem. Looking above at the Line 3 Limitation Chart Worksheet, just fill out your yearly contribution limit for those months you did have coverage. Other months when you didn’t have HSA coverage (say through a job, COBRA, other plan, etc.) can have a big fat 0. The zeroes don’t cause a problem, they just don’t add to your contribution limit for the year. For example, your data might look like this:

- January – $3,350

- February – $0

- March – $0

- April – $3,350

- (etc.)

Just add them up, and divide by 12 to get your contribution limit.

#4: My health insurance changed throughout the year, from single to family, what is my HSA contribution limit?

Perhaps sometime during the year, your spouse was added onto your plan. You previously qualified for single ($3,350) coverage, but with the addition of your spouse (or kids) you qualified for family ($6,750) coverage. Then your spouse / kids left the plan. A few months of Family contribution limit, and then back to single.

No problem, just plug those numbers into the chart:

Whatever your combination is, just plug the yearly contribution limit into the month, and then divide by 12.

————————————

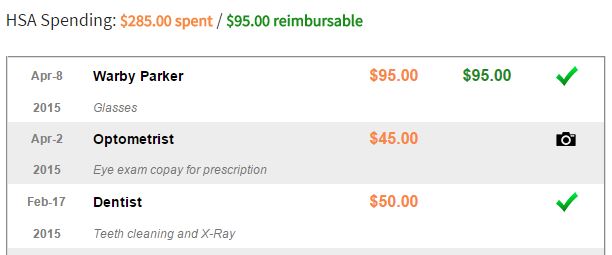

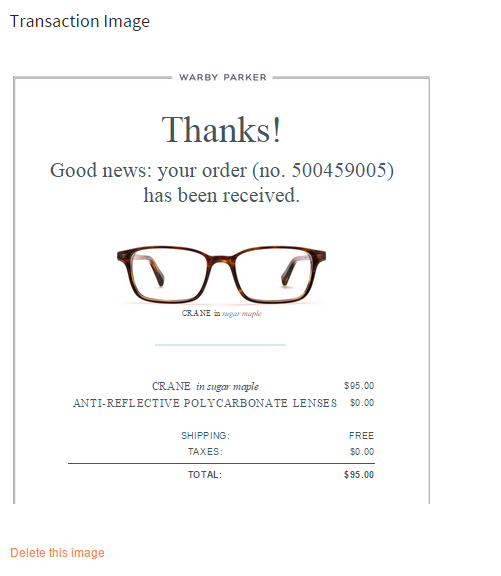

Note: if you have an HSA, please consider using my free service TrackHSA.com to manage your Health Savings Account. You can store purchases, receipts, and reimbursements securely online for free.