Your Health Savings Account remains yours no matter what happens in life, but how you use it can vary depending on the event. This post lists the following events related to changing jobs, retirement, and old age and describes what happens to your HSA when they occur.

What happens to your HSA when you switch plans?

With as crazy as the job market and health care is nowadays, there is a good chance that your insurance plan will change in the future. The key is to understand your new insurance and if it is HSA eligible. During sign up or open enrollment, many plans will explicitly say “HSA eligible” as it is a selling point for many. Look for that indicator, but even if is not called out, your plan may still be HSA eligible. To determine this, you only need to confirm that your plan fits within the HSA requirements for 1) minimum deductible and 2) maximum out of pocket limit. If this is true, then your plan is HSA eligible and you can carry on as before.

If your plan is not HSA eligible, you will not be able to make further contributions to it.

- Health Savings Account – Any previously allocated funds remain yours and can be spent on qualified medical expenses.

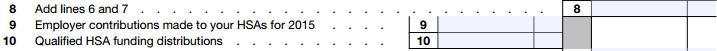

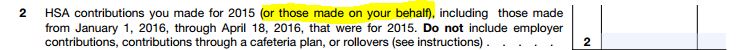

- Contributions – If your plan is HSA eligible, you can contribute the single/family amount for that year. If your new plan is not HSA eligible, you cannot make further contributions for those months you did not have HSA eligible coverage.

- Distributions – You may spend your existing HSA dollars on any qualified medical expense.

What happens to your HSA when your job changes?

Since your health insurance generally related to your job, changing jobs almost always changes your health insurance plan or provider. As such, this situation has similar implications to the above section and the key is to determine if your new health insurance is HSA eligible or not.

- Health Savings Account – Any previously allocated funds remain yours and can be spent on qualified medical expenses, even if your new job does not offer HSA eligible health insurance plans.

- Contributions – If your new job’s plan is HSA eligible, you can contribute the single/family amount for that year. If the new plan is not HSA eligible, you cannot make further contributions for those months you did not have HSA eligible coverage. Remember that you can contribute pro rata for months that you did have HSA eligible insurance. So if you change jobs in July to no HSA coverage, but had HSA eligible insurance from January – June, you can contribute 6/12 or 1/2 of that year’s contribution limit.

- Distributions – You may spend your existing HSA dollars on any qualified medical expense.

What happens to your HSA when you are terminated/fired?

We have all been there: for whatever reason your job is not working out so you quit or are laid off / fired / let go. This sucks, but you have to be smart and manage your health insurance as you find your next job. The key is to remain covered so that an unexpected health insurance bill does not become your responsibility (e.g. an unexpected appendicitis results in a $25k medical bill).

One option you may be presented is continuing your existing (HSA) coverage under COBRA insurance offered by your previous employer. COBRA coverage functions as a continuation of your coverage, so it will maintain HSA eligibility if your plan is HSA eligible. Thus, you can continue making HSA contributions under COBRA insurance.

If you have to find new insurance, see the first section on switching your plan, as the new plan’s HSA eligibility will determine whether you can continue contribution or not.

- Health Savings Account – Any previously allocated funds remain yours and can be spent on qualified medical expenses. Note that while you are receiving unemployment benefits, your HSA can be spent on health insurance premiums (see: How to use your HSA when Unemployed).

- Contributions – While you may not want to make HSA contributions while unemployed, you certainly can if you are covered by HSA eligible insurance. This might be COBRA insurance or coverage you get on your own.

- Distributions – You may spend your existing HSA dollars on any qualified medical expense, including health insurance premiums while receiving unemployment benefits.

What happens to your HSA when you retire?

Congratulations, you’ve made it! Your Health Savings Account will still be with you at retirement, and there is no need to spend it or withdraw it for any reason. In fact, you can continue making contributions as long as you have HSA eligible insurance and are not on Medicare. If you are over age 55, you can also make catch up contributions which are generally an additional $1,000 on top of your normal contribution amount.

If you are over age 65, a special benefit of Health Savings Accounts begins. At this age, you can use HSA funds for anything, not just qualified medical expenses. That’s right, you can make penalty free distributions for any reason. This is how HSA’s can function as a back door retirement vehicle. Before age 65, if you spend your HSA on non qualified medical expenses, you will owe tax (to undo the tax benefit you receive) and penalty. After 65, you will only owe tax on those dollars not spent on medical expenses (no penalty). This functions just like a traditional (pre tax) IRA, just as another vehicle. That said, it might make most sense to keep the HSA for any medical expenses that arise, since that will of course be tax free.

- Health Savings Account – This remain yours just as before.

- Contributions – If you have HSA eligible insurance, you can make contributions. You cannot contribute if you are on Medicare.

- Distributions – Of course, HSA monies can be spent on qualified medical expenses, or if you are over 65, on anything you like (but you must pay tax).

What happens to your HSA when you begin Medicare?

You cannot contribute to your HSA for any month that you are receiving Medicare benefits. However, if you start Medicare in September and had HSA eligible coverage from January – August, you can still contribute 8/12 or 3/4 of your yearly contribution limit. But if your spouse is under 65 you could always contribute to their HSA to continue funding an account.

The good news is that you can use your Health Savings Account to pay for Medicare A, B, D and Medicare HMO premiums. These count as qualified medical expenses so they are tax and penalty free. If you pay for premiums directly through Social Security, you can transfer (pre-tax) money in your HSA to you bank account to reimburse yourself, effectively paying for them with your HSA.

- Health Savings Account – This remain yours just as before.

- Contributions – You cannot make contributions if you are receiving Medicare benefits.

- Distributions – Your HSA can still be spent on qualified medical expenses, and Medicare A, B, D and HMO premiums count as qualified medical expenses. if you are over 65, you can spend your HSA on anything you like, but treated it will be treated as income and taxed.

What happens to your HSA when you die?

It is important to name an account beneficiary for your Health Savings Account. Otherwise, your HSA will be treated as part of your estate and taxed. If you name your spouse as the account beneficiary, the HSA transfers to them ans remains an HSA, offering them all of the benefits of the account. They are not required to maintain HSA eligible insurance and can use the HSA funds for qualified medical expenses, or if they are over 65, for anything they like.

If someone other than your spouse is named as the HSA account beneficiary, your HSA will be closed and the monies will be distributed and taxed to the beneficiary. However, there is a special provision that allows the beneficiary to spend the HSA funds on the deceased’s medical costs, for up to one year after death. That allows them to spend the money tax free and avoid further taxes from the government.

- Health Savings Account – Passes to beneficiary. If beneficiary is your spouse, remains an HSA. If beneficiary is not your spouse, it is closed and taxed.

- Contributions – No further contributions. The exception is if the HSA transfers to your spouse, who is also HSA eligible, and can thus contribute.

- Distributions – If transferred to spouse, the account continues to function as an HSA. If not, your final medical expenses can be paid using the HSA for up to 1 year. The remaining account is liquidated to the beneficiary and taxed.