This post is based on a great question that came from an HSA Edge reader. Feel free to email any questions you may have to evan@HSAedge.com

We all know that our Health Savings Account has a contribution limit (2014 = $3,300 / $6,550), a maximum amount of tax free contribution that cannot be exceeded during the year. This is all fine and dandy assuming you start the year with an HSA plan and end the year with the same HSA plan. But what if your health insurance changes mid year? How does this affect your HSA? It turns out, changing your health insurance during a fiscal year can have an impact on how much you can contribute. If not followed properly, this can lead you to over contribute, causing painful penalties or taxes.

Below are 3 scenarios that show how changing your health insurance affects your contributions:

1) Sign up for HSA eligible insurance during the year

If you sign up for an HSA eligible health insurance plan during the year, you are on the right track to open a health savings account and begin contributing. You are allowed to make full contributions for a year if you are covered by HSA eligible health insurance on December 1st of that year. This is explained in detail in the post on the Last Month Rule. The summary is that when you start a new HSA eligible health insurance plan, you can contribute up to the maximum contribution limit during the first year if you had coverage on the first day of the last month of the year. In other words, if you have a plan opened by December 1st, you can contribute up to the max.

However, this is enforced by the Testing Period, which says that if you are going to take advantage in that first year and contribute more than your pro-rata share, you have to stay on an HSA eligible plan for a corresponding time during that subsequent year. If not, you have in fact over contributed and penalties / taxes occur. Thus, if you are going to sneak in a full year contribution during your first year on an HSA plan, make sure you are not just a flash in the pan and are planning on staying on that plan for a while.

2) Switch health insurance plans to other HSA eligible plan mid year

This is quite simple: if you change health insurance plans, and both are HSA eligible, there is no effect to your contribution amount for the year. In the IRS’s eyes, you are covered by an HSA eligible plan for the full year, so you are able to make full contributions. The example here is you have an HSA eligible plan Jan > May, but in June you hop on an employer sponsored plan that is also HSA elibile. No problem, go ahead and make full contributions.

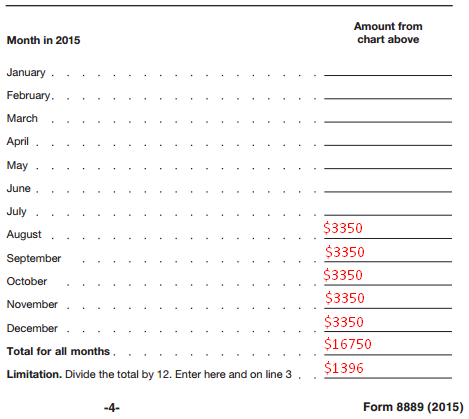

However, remember that the test for HSA eligibility occurs on the first of the month. This means that on the first day of each month, if you have HSA insurance and are an eligible individual, you “earn” 1/12th of the maximum contribution limit for that month. It follows that if you have coverage in each month, you earn 12/12 or 100% of the maximum contribution limit for the year. On the other hand, if you make a switch that is not in effect on the first of the month, you will lose that 1/12th of the contribution limit. The effect is your contribution limit is reduced and only equal to those months you have coverage.

The alternative scenario is covered by the final section…

3) Leave a HSA eligible plan mid year

Same scenario, covered by HSA eligible plan Jan > May, but you switch to a health insurance plan that is not HSA eligible in the middle of the year. What then?

This is where things get tricky. While the IRS is not super clear on this, the interpretation is that you are only allowed to contribute to an HSA for the months of a year you remain on the insurance plan. Basically, contribution limits are pro-rata based on the amount of time you are on the plan. If you are single ($3,300 2014 max) on the plan for 6 months, your maximum contribution limit is (6/12 * $3300) = $1,650. If you on the plan for 10 months, your maximum contribution = (10/12 * $3300) = $2,750. You are effectively capped out when you quit the plan to avoid taking advantage of the tax break.

That raises the real risk of penalties and taxes resulting from over-contributing. Consider the following scenario:

- Strong earner

- Maxes out HSA contribution early in year

- Due to unforeseen circumstances, no longer HSA eligible sometime mid year

This presents a real problem for that person as they have in effect over contributed for the year. Even if they were able to reimburse their full contribution against qualified medical expenses, they have deducted too much from their income and will result with over contribution penalties and taxes, which are evil. The advice is you may want to space out your yearly HSA contributions by month / quarter as to avoid the risk of over contribution. This does not mean you cannot reimburse for prior medical expenses. In this scenario, you could incur $3,300 in qualified medical expenses in January and contribute monthly, reimbursing yourself for that $3,300 over time. However, this strategy puts a circuit breaker in the equation should you change health insurance to a non HSA eligible plan mid year, preventing you from penalties and taxes.

Note: to regardless of your coverage, to track your HSA spending please consider my service TrackHSA.com for your Health Savings Account record keeping. You can store purchases, upload receipts, and record reimbursements securely online.