This is a fairly frequent question from readers who ask, “Who can contribute to an HSA?” or “Who can contribute to my HSA?” These questions take a couple of forms and includes some assumptions, so we will first explain the basics and move to the specifics.

You must have an HSA for anyone to contribute to it

First things first, you must at least open and have a Health Savings Account to be able to contribute to it. Contributing isn’t just some earmark/declaration you make when you file taxes; instead, HSA contributions go to an actual bank account, just like what you might use for checking and savings. This bank account is yours forever and is designated for qualified medical expenses. At retirement age, you can use the account for whatever you like.

You must have HSA eligible insurance in the year to have HSA contributions

A second requirement of contributing to your HSA is that you have HSA eligible health insurance during the year you wish to contribute. This also applies to employer or other contributions (see below) you may receive. You must have a high deductible health plan (HDHP) that meets that year’s HSA requirements to make or receive any contributions. Unfortunately, this prevents you from contributing to an old Health Savings Account if you no longer have qualifying insurance. You have to have coverage at some point during the tax year to make contributions. The key phrase “during the tax year” is important there. This does not mean that you need to currently have coverage to contribute to the HSA. If you had HSA eligible coverage at any point during the year, you can at least make a partial contribution to your HSA.

For example, assume that you had HSA eligible self-only insurance from January – July, and then ended coverage. You made no contributions during that time. You might think that since you made no contributions, you missed out and can contribute nothing to your HSA for the year. This is is not the case. In fact, you are allowed to contribute on a monthly pro-rata basis for the year, in this case 6/12 months or 1/2 of your contribution limit. Health Savings Account contributions and limits are viewed on yearly timeline, and you can even contribute to your HSA in the following year, using what is called a Prior Year Contribution.Now onto who can actually make contributions to your Health Savings Account.

1) The account holder (you) can contribute to your HSA

Of course, you can make contributions to your own HSA. This is the most common form of contribution and can take two forms, either a cafeteria plan contribution (pre tax), or a manual contribution (post tax) . While the method and timing differs, both result in the same tax benefits once you file taxes. Cafeteria plan contributions are arranged by your employer and remove your HSA contributions from your paycheck on a pre tax basis. These amounts are deposited into your HSA and you enjoy immediate tax savings. Alternatively, you can make manual contributions to your HSA. This is probably the most common method and involves getting paid, paying taxes, and then depositing or transferring post tax money to your Health Savings Account. At tax time, these deposits are retroactively removed from your taxable income, so you reap the tax deduction benefit at tax time.

![]()

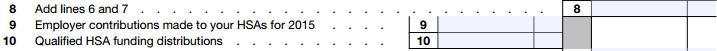

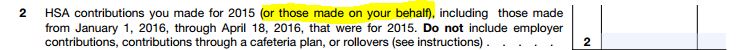

The method in which you make contributions to your HSA also determines how you file HSA tax Form 8889. The above image shows that manual contributions (post tax) made on line 2, whereas cafeteria contributions (pre tax) are made on line 9 (see next image).

2) Your employer can contribute to your HSA

You can also receive employer contributions to your Health Savings Account. This is a great perk because your employer is in effect giving you free money to use for your healthcare. The schedule and amounts at which they contribute will vary based on your employer. Some employers will provide a small contribution to your HSA’s, whereas others may be very generous and fund your entire HSA. Either way, employer contributions are factored into Form 8889 on Line 9.

Please note, that per the above discussion, that you must have HSA eligible insurance to receive employer contributions to your HSA. So if your employer offers a great benefit like a HSA contribution, but you choose a non-HSA eligible insurance, you cannot take part in that benefit.

3) Other people can contribute to your HSA

Another benefit of Health Savings Accounts is that anyone can contribute to your HSA. This means that you can contribute to anyone’s HSA, and conversely that your parent, grandparent, rich aunt/uncle, or friend can contribute to your HSA. The best part is that the recipient of the contribution receives the tax deduction for the amount contributed, so that is a second order effect, besides having funds in the HSA.

Note that you must declare contributions from others on your Form 8889 on line 2.

Note: all contributions count toward your contribution limit

Remember that all contributions made to your Health Savings Account count toward your yearly contribution limit. This means that you must take into account employer contributions (and contributions from ‘others’) when you determine how much can be contributed to your HSA for the year.

For example, say you have self-only HSA eligible insurance for all of 2016, affording you a $3,350 maximum contribution limit. If your employer generously contributes $3,000 to your HSA, and your parents chip in an additional $300, you would only be allowed to contribute $50 yourself without incurring excess contributions.