Overview

Excess Contributions occur when you contribute more to your HSA than you were allowed. This compares your contribution limit for the year (which can vary on many factors) and the actual amount of money that came into your HSA, including such things as Employer Contributions, Qualified Funding Distributions, and Prior Year Contributions. That being said, if you find yourself in a situation facing Excess Contributions, you may find it a challenge come tax time when you are faced with Form 8889. Fear not, as this article will guide you through how to avoid taxes and penalties and get this IRS required tax form filed.

Include the Excess Amount in Contributions

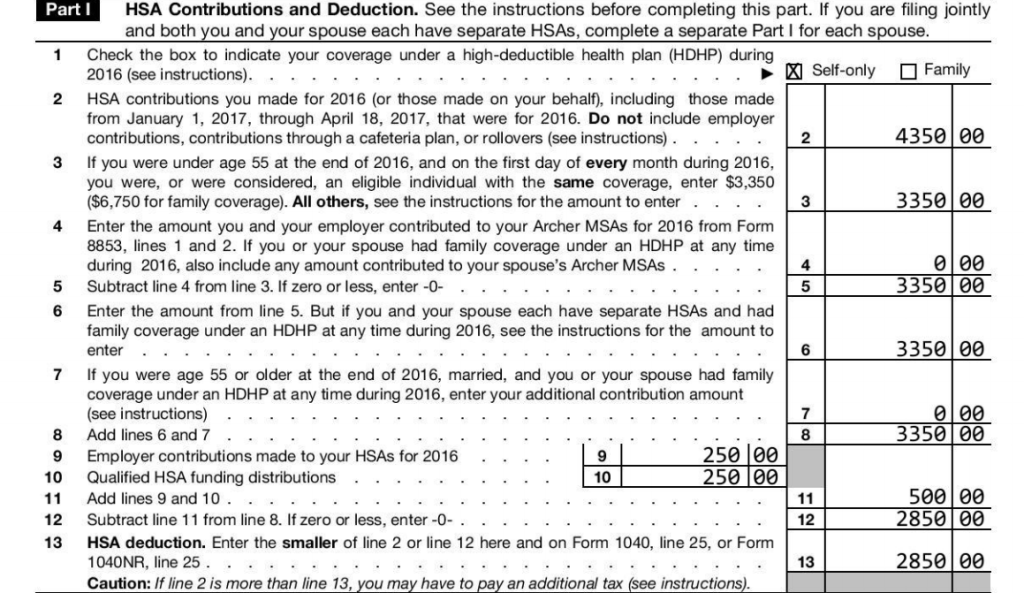

Part I of Form 8889 is appropriately called “Contributions”. It details amounts contributed to your HSA, your contribution limit, and calculates the deductible amount that flows over to Form 1040. It will feel strange, but you want to include all amounts contributed to your HSA, even if they are in excess. Doing so accurately reflects the account activity, so that when your HSA custodian provides Form 5498-SA to the IRS, the amount contributed will match your Form 8889. Remember, there is no taxes and penalty for having excess contributions in your HSA, if you remove them (and any earnings) before your tax filing deadline. The point is it is OK to show excess contributions in the contribution section of Form 8889, the key is that you have to proactively take care of them.

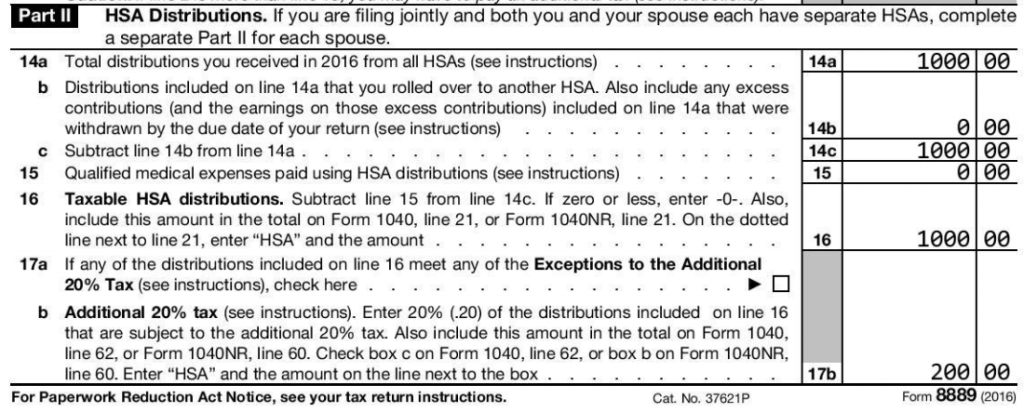

Example: Excess Contributions on Form 8889 Part I – Contributions

In this example we contributed $4,850 (contribution, employer contribution, and funding distribution) to our HSA. However, our contribution limit was only $3350, leading to an excess contribution of $1,500. The key is that we have included all contributions that caused the excess contributions and lived to tell the tale.

An example of 2016 Form 8889 prepared by EasyForm8889.com

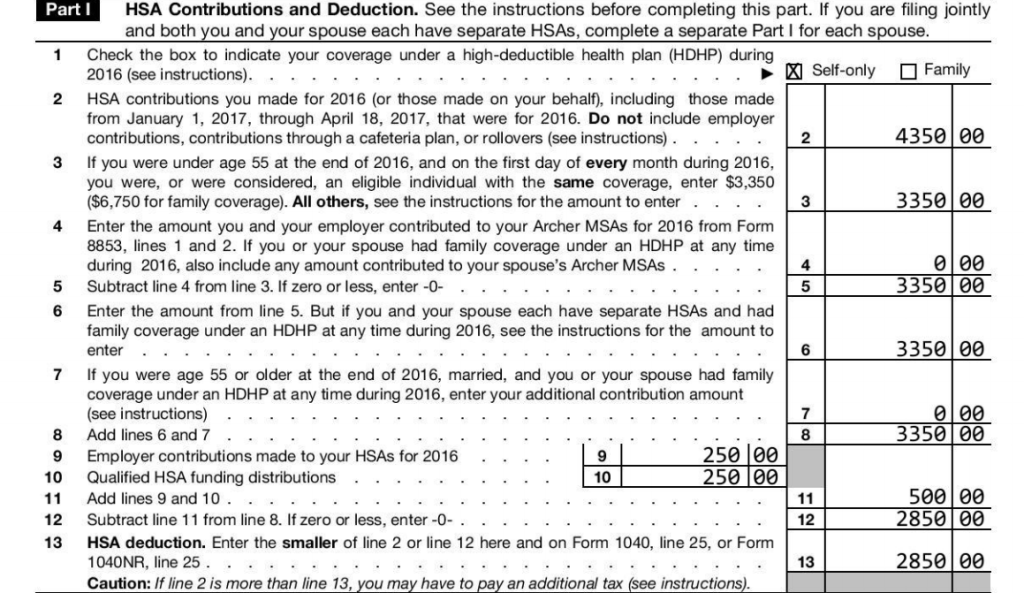

Notice the warning at the bottom that states:

“Caution: If line 2 is more than line 13, you may have to pay an additional tax (see instructions).

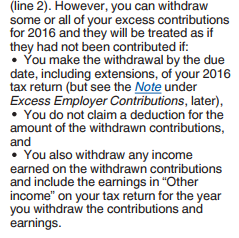

Our Line 2 ($4,350) is indeed greater than Line 13 ($2,850), so we are at risk of paying excess tax. However, per the instructions, if we remove the excess contribution and any earnings on it before the tax deadline, we owe no taxes or penalty:

To rectify this scenario, we would need to log into our Health Savings Account and request a distribution that specifically states it is a removal of an excess contribution for 2016 (see next section). You must specify this so that they don’t code it as a regular distribution for qualified medical expenses. In the above example this would be for $1,500 coming back out of the HSA. We will account for that removal in the next section.

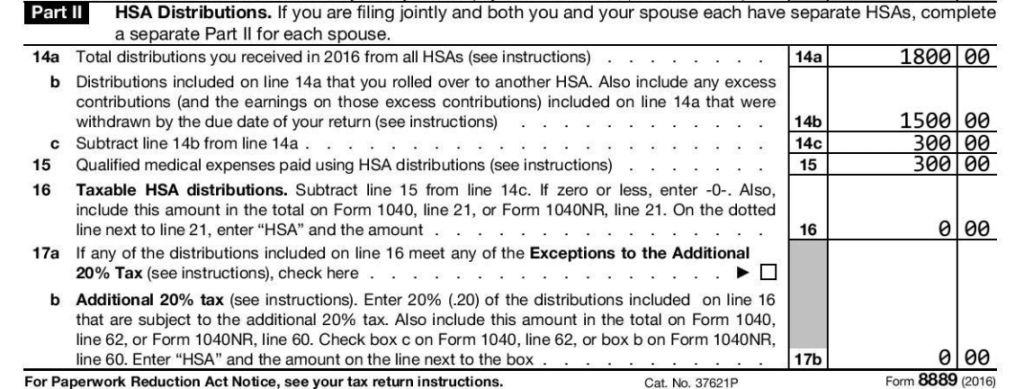

Include the Excess Amount in Distributions

Part II of Form 8889 is called “Distributions” and details money that came out of your HSA. Similar to the logic stated in Part I, we need to be transparent about the excess contribution to avoid the ire of the IRS (and taxes and penalty). We will do this by 1) counting the removed excess contribution as a distribution and 2) calling it out as a distribution due to excess contribution. Again, you need to remove excess contributions (and any earnings) from your HSA before the tax filing deadline, and doing so creates a distribution from your HSA.

To actually remove the excess contribution, you need to go to the website of your HSA custodian and create a distribution for the excess contribution. When you do this (important), there should be a box stating “I am removing an excess contribution from my HSA”. This differentiates the distribution from one being used for qualified medical expenses, and informs your HSA custodian how to code the distribution on Form 1099-SA. If you correct the excess contribution before tax year end, this distribution will be reported on that year’s Form 1099-SA. If you do this in the following year (say, Jan-April 15th, before tax day), your HSA custodian may or may not send you a 1099-SA for the distribution before tax day. If they don’t, you need to keep that distribution of excess contributions in mind for filing taxes.

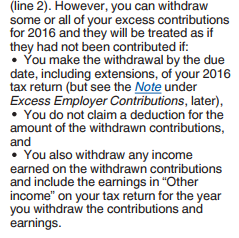

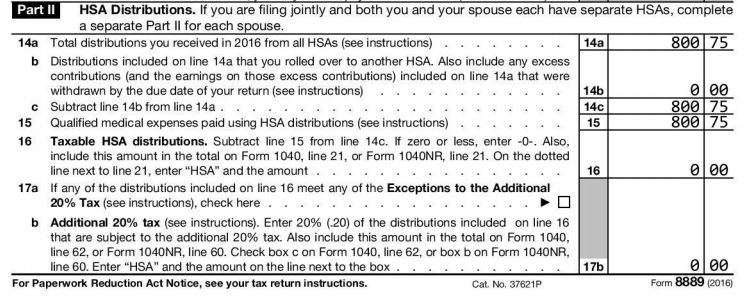

Example: Excess Contributions on Form 8889 Part II – Distributions

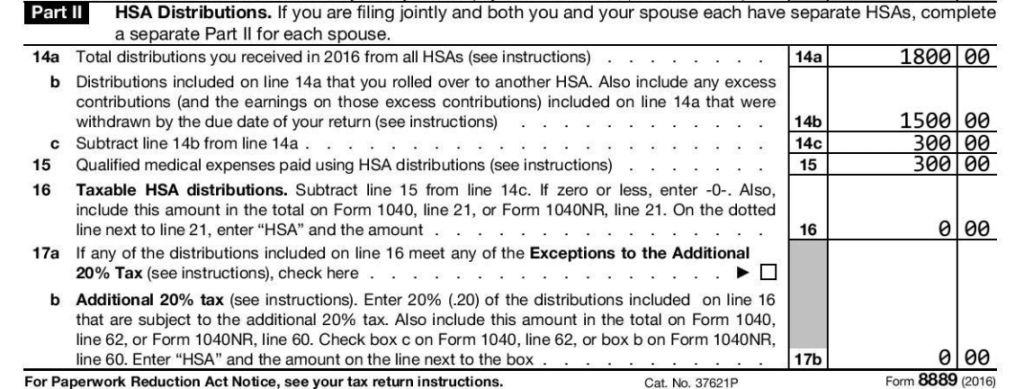

Reporting this activity on Form 8889 is relatively easy, as there is a mechanism in Line 14 that handles excess contributions for us. Back to our example of a $1,500 excess contribution that was removed, our Form 8889 ends up looking like this:

An example of 2016 Form 8889 prepared by EasyForm8889.com

Line 14 has 3 parts that we use to detail our distributions. We include the excess contributions removed in this total amount, and call out the amounts that were removed due to excess in 14b. The breakdown of line 14 is below:

- Line 14a – The total amount of distributions for the year, including those for excess contributions and their earnings

- Line 14b – Distributions that were for excess contributions and their earnings

- Line 14c – A calculation of distributions that should have been spent on qualified medical expenses

As you can see, excess contributions avoid taxes here because they are excluded from Line 14c. If any amounts in 14c are not spent on qualified medical expenses, they are taxed and penalized. We stated that $300 that we normally distributed was spent on qualified medical expenses, by tracking our receipts in a tool like TrackHSA.com. The takeaway from the above logic is that the IRS does not expect you to spend excess contributions on QME, and does not tax or penalize you on these distributions if they are handled properly.

————————————

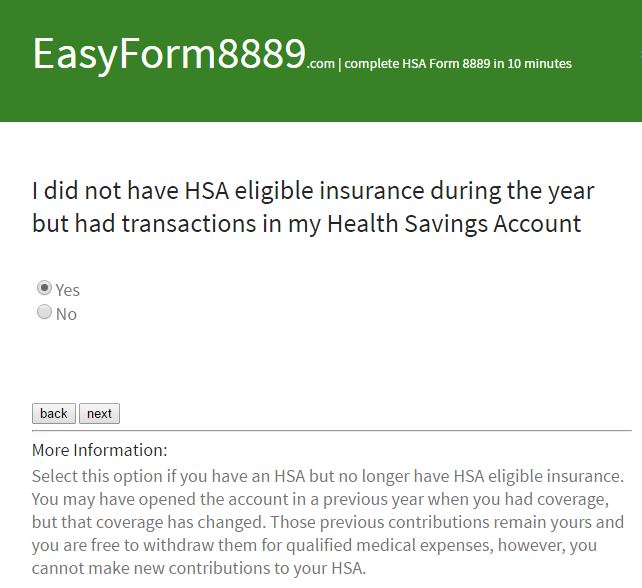

Note: if you want step by step instructions for your Excess Contributions on Form 8899, or just want to get it right the first time, please consider using my service EasyForm8889.com to complete Form 8889. It is fast and painless, no matter how complicated your HSA situation may be.