Form 5498-SA is an informational tax form related to Health Savings Accounts. It is provided by your HSA Trustee (or Custodian) and the IRS requires it be sent to you each year that you make contributions to your HSA. It provides the “official” accounting of your HSA for the year and documents:

- The HSA trustee

- The HSA account holder and account number

- Total contributions made

- Prior year contributions made

- HSA rollover contributions made

- HSA account balance

In essence, it is serves as a year end statement for your HSA (or unrelated to this blog, your MSA or Medicare Advantage) and is used to file HSA tax Form 8889 as well as your personal income taxes.

What should I do with Form 5498-SA?

Form 5498-SA is critically important to filing your taxes. It serves as the source of truth for what was contributed to your HSA for the tax year as well as defining Prior Year Contributions and HSA Rollover contributions. Without referencing Form 5498-SA when you prepare your taxes, you run the risk of incorrectly reporting your HSA contributions for the year. This could lead to missed tax savings or even additional taxes and penalties being assessed later.

You need to reference Form 5498-SA when you complete Form 8889, which is the tax form required for Health Savings Accounts (see article: How to File Form 8889). Box 2 is key as it describes all contributions made to your HSA during the year. You will use this number on Line 2 of Form 8889 to indicate your HSA contributions for the year. However, you will first need to remove any employer contributions to your HSA. If your employer made contributions to your HSA, this can be found on your W-2, and should be subtracted from Box 2 of Form 5498-SA to determine your personal contribution amount. Employer contributions go on Line 9 of Form 8889.

Note that if you made a qualified funding distribution (IRA to HSA transfer), this amount is reflected in Box 2 of Form 5498-SA. That amount will also need to go in Line 10 of Form 8889.

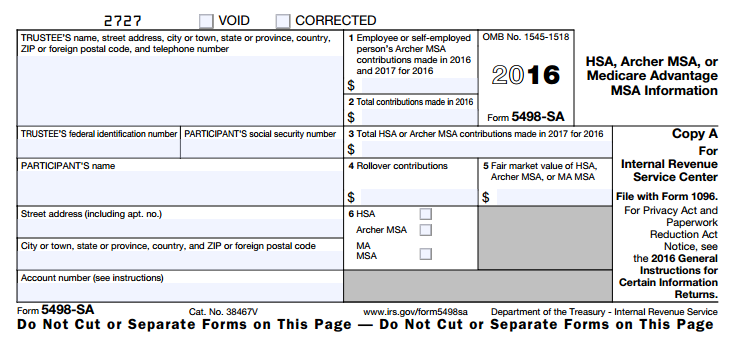

What does Form 5498-SA look like

Form 5498-SA is a fairly simple form but may change from year to year depending on IRS rules and regulations. Here is a blank example for 2016:

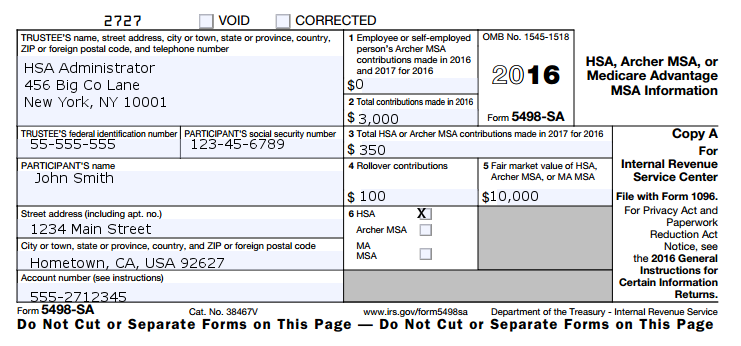

And here is what an example completed Form-5498-SA might look like, which is what you receive:

In the above example, the HSA holder maxed out their HSA for the year ($3,350). They did this by contributing $3,000 during the year (note: this $3,000 may include employer contributions), and in the following year (before April 15th) made a $350 prior year contribution. They also transferred $100 from another HSA (not counted as a contribution) and their year end balance of their HSA was $10,000.

Boxes on Form 5498-SA

The left part of Form 5498-SA details account information about the holder and account trustee. Most of this is self explanatory, with the most important piece of information being the “Account Number” which is the identifier assigned by your HSA trustee. In theory, if you had multiple accounts (i.e. HSA and MSA) at the same trustee, you would receive two Form 5498-SA’s and the account number would be shown here.

The right section of Form 5498-SA shows activity related to your HSA in 6 key boxes:

- Box 1 – Archer MSA contributions. This only includes Archer MSA contributions for the year and and does not apply to HSA’s.

- Box 2 – Total Contributions. All contributions made to the HSA’s for the year are shown here. This includes qualified HSA Funding Distributions (IRA > HSA transfers) as well as employer contributions.

- Box 3 – Prior Year Contributions. Shows all contributions made in subsequent year for prior the prior tax year.

- Box 4 – Rollover contributions. This amount is not included in box 1, 2, or 3. Shown here are rollover contributions from other HSA (or MSA) accounts, so this does not count towards your contribution limit for the year. It is merely transferring HSA dollars to this HSA account.

- Box 5 – Fair Market Value. The value of your account as of the end of the tax year.

- Box 6 – Type of account. This shows the type of account being reported on Form 5498-SA, which should be “HSA”.

(Note: this form doubles for MSA’s and Medicare Advantage, but we will only discuss HSA application here).