This question was submitted by HSA reader Jennifer. Send yours in to evan@hsaedge.com

In 2015 I had health coverage under my spouse’s PPO. We divorced and I went on the Health Exchange effective July 1. I also opened a HDHP and an HSA account effective July 1, 2015. I contributed the full family amount of $6650 because my kids are on it too.

It was my understanding that as long as I was an eligible individual on December 1, 2015, I could deduct the full $6650 on my 2015 return. According to the Last Month Rule, I thought I would have a testing period for the next 12 months (and I do plan on staying on this same plan with HSA). My accountant is saying I have to prorate for 6 months, and I can only deduct $3325. Is he correct? If he is, I don’t understand the point of the Last Month Rule.

Thanks for your email, you are exactly correct in your interpretation of the Last Month Rule. For reference, here is a detailed article about the HSA Last Month Rule / Testing Period.

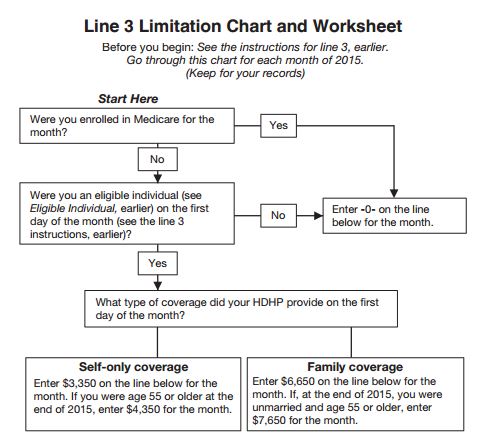

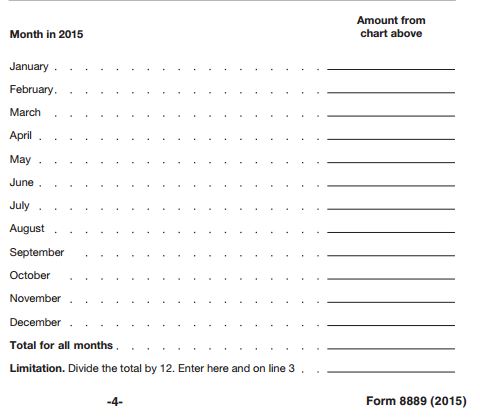

Your accountant is correct that the general theme of calculating Line 3 (contribution amount) is pro rata across months. See this post on Determining your Contribution Limit. However, like you said, there is an exception which is the Last Month Rule and your situation appears to fully warrant its use. Per Form 8889 Instructions:

Last Month Rule: if you are an eligible individual on the first day of the last month of your tax year (December 1 for most taxpayers), you are considered to be an eligible individual for the entire year.

Thus, as long as you have health insurance on December 1st, you can contribute up to the full amount for that year’s contribution limit, based on the type of insurance you had on December 1st (Family / Single).

But as Jennifer astutely pointed out, she has to maintain compliance with the Testing Period. Again, back to Form 8889 Instructions:

Testing Period: you must remain an eligible individual during the testing period. The testing period begins with the last month of your tax year and ends on the last day of the 12th month following that month (for example, December 1, 2015 – December 31, 2016). If you fail to remain an eligible individual during this period, other than because of death or becoming disabled, you will have to include in income the total contributions made that would not have been made except for the last-month rule. You include this amount in income in the year in which you fail to be an eligible individual. This amount is also subject to a 10% additional tax.

Thus, if you take advantage of the HSA’s Last Month Rule, make sure you plan on maintaining HSA eligible health insurance for the following year. Otherwise, the next year you will face a penalty in Part III of Form 8889 for 10%, plus owe taxes on that amount.

————————————

Note: if you have an HSA, please consider using my free service TrackHSA.com to manage your Health Savings Account. You can store purchases, receipts, and reimbursements securely online for free.