This was a reader question submitted by HSA Edge reader Beata. If you have a question get in touch and we’ll try to help. Email us at evan@hsaedge.com any time.

I was no longer under the High Deductible Plan with my new employer in 2017, however I had some left over funds in my HSA account from my previous employer. No contributions were made in 2016.

I used up all the funds in 2016 for qualified medical expenses. Do I skip parts I and III on the form and just fill out part II about the distributions?

Overview

This is a pretty common scenario that occurs as life goes by and people change insurance coverage. Frequently, people who previously had and contributed to an HSA eventually change coverage to a non-HSA eligible plan, due to a job change, insurance change, or life event. One of the great benefits of Health Savings Accounts is that the money remains yours forever, even if your coverage changes. This contrasts with other health plans like FSA’s where there is a “use it or lose it” clause on the plan, forcing you to predetermine a contribution amount and spend it in the year. Thus, the good news is you still have your HSA funds to spend on qualified medical expenses, but how do you file HSA tax Form 8889?

If You Spent Funds, You Need to File Form 8889

First things first, you definitely need to file Form 8889 if this situation applies to you. Even if you had the HSA plan 10 years ago, and are no longer contributing to the account, as long as you are spending funds from the HSA the government wants to know about it. The hard and fast rule is if money is going into or out of your Health Savings Account, you need to file Form 8889 for the tax year in which that spending occurred. This form is due by your tax filing deadline, and can be extended if extension is filed. It will be best just to file it with your regular taxes.

Note that if you don’t contribute to or withdraw from an HSA in a given year, you likely do not need to file Form 8889 for that year.

What follows is a summary discussion of filing Form 8889 if you no longer have HSA coverage but spent old HSA funds this year. More detailed information can be found about How to File Form 8889.

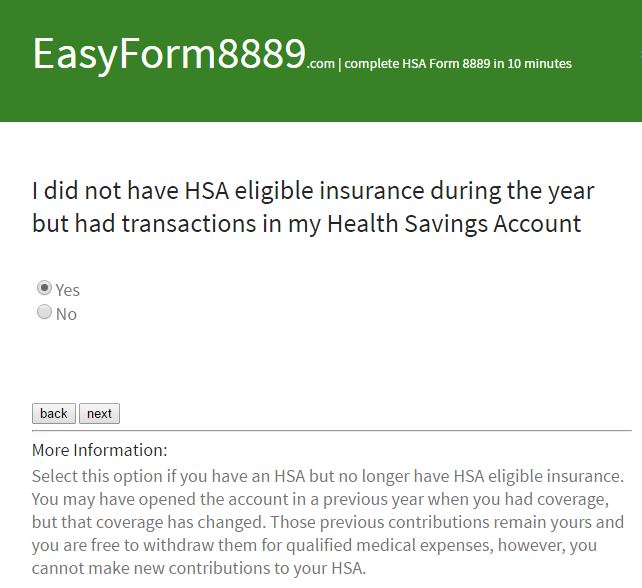

Part I – Contributions

Form 8889 consists of 3 parts, and the first one should be fairly straightforward. It’s main focus is determining your contribution limit and the amount you (and others) contributed during the year. Since the topic of this post is that you no longer have HSA coverage (but have funds in an HSA account), you will neither have 1) a contribution limit or 2) (allowable) HSA contributions. As such, this section will be all $0’s, which logically follows that your deductible amount (Line 13) will also be $0 and flow over as such to Form 1040.

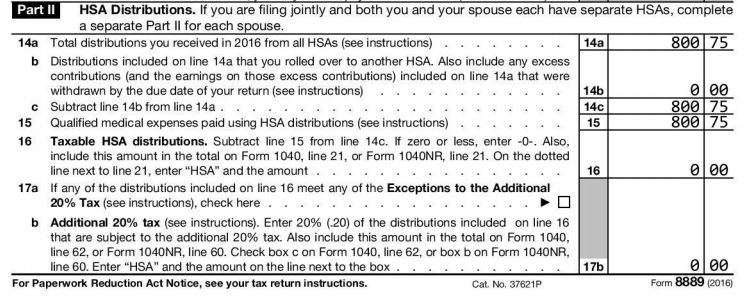

Part II – Distributions

The second part of Form 8889 details the funds that exited your HSA, and this is where you will have to do some work. Line 14a and 15 are the main tasks here, and they are asking “How much exited your HSA” and, “How much did you spend on Qualified Medical Expenses?”. Ideally, both of these amounts should be the same: any money I withdraw from my HSA should be spent appropriately. If that is the case, you will face no taxes and penalties, but as you can see in subsequent lines 16 and 17b, any delta between those numbers will be taxed and penalized.

This 2016 Form 8889 was prepared by EasyForm8889.com.

Part III – Taxes & Penalties

Part 3 of Form 8889 involves a calculation of various taxes and penalties you might owe. These can arise from failure to comply with the Testing Periods set forth in the Last Month Rule and Qualified Funding Distributions. Hopefully, these do not apply to you if you are simply spending remaining funds from an old HSA. If so, this section will be blank and you can just add $0’s there as well.

However, if you recently ended insurance and in the prior year 1) utilized the Last Month Rule to increase your contribution or 2) utilized a Qualified Funding Distribution from a IRA/Roth IRA, you could be in trouble. Both of these contain a Testing Period that stipulates continued HSA eligibility conditional with their use, in an effort to prevent tax abuse. If you fail to maintain coverage for the specific Testing Period, your contribution is considered “excessive” and will be taxed and penalized for the tax year in question. It is best to fully understand these rules before engaging them, and if you are facing a penalty, thoroughly review how they are calculated or use a service like EasyForm8889.com.