With the recent train wreck of an implementation of the Affordable Care Act (i.e. Obamacare), many are wondering how their HSA plans are affected. Are there still HSA plans available? What has changed?

The good news that HSA plans are still available and, given current incentives from the administration, will likely continue to grow in popularity. However, the administration has used the 1000+ page Affordable Care Act (2010) to take a few hits at HSA plans.

Major changes to HSA plans

- Increased penalty for early withdrawal of funds. Previously, if you needed to withdraw funds for non Qualified Medical Expenses, the penalty was 10% of the withdrawal. Now, the administration has upped this penaly to 20%. Thus, further care should be considered when planning your finances as the penalty is higher – even though it is your money.

- Over the counter drugs (except insulin) are no longer a Qualified Medical Expense. Previously, spending on medical related over-the-counter drugs that you find at a local pharmacy were considered QME. However, these are no longer considered QME, so only prescription drugs will qualify.

- Coverage for dependents ends at age 24. Unlike regular health insurance plans that can cover dependent up until the age of 26, HSA plans are only eligible to cover dependents until the age of 24.

Like the majority of the healthcare market, Obamacare has affected the HSA industry with the above (arbitrary) changes. The changes seem punitive in nature in that they reduce the benefits of an HSA. It is a shame that the administration does not use the law to create advancements in HSA policy but instead uses it to penalize hard working savers.

Choosing an HSA Plan under Obamacare

Either way, the HSA is still the best way to save for your future medical care and retirement. Don’t let the changes hold you back.

If you are purchasing health insurance on a state exchange, you still need to make sure your plan meets certain requirements to be considered eligible for an HSA. You can review the 2014 HSA Plan Definitions and ensure your plan fits. Likely, these will be in the Bronze and Silver categories.

The short answer is your plan will need to a have minimum yearly deductible of $1,250 / $2,250 (individual / family) and a maximum out of pocket expense of $6,350 / $12,700. If your plan falls within these guidelines, and you are not a dependent, have other health insurance, or be on Medicare, you can open an HSA. See the full guidelines here.

What if I already have an HSA plan and need to change?

If you already have a health savings account and are required to change plans, you have a few options.

Ideally, you could change into a plan that is also HSA compatible (see above). That way, you can still contribute to your health savings account and continue to save and invest for the future. Nothing materially changes with your HSA except for your health insurance provider.

However, you may find that you are purchasing a new plan that is not HSA compatible. In this case, you can no longer make contributions to your HSA but, have no fear, the money is still yours (forever). In this case, you have a few options:

- Continue to purchase qualified medical expenses using the HSA until it is depleted. In that case, you have saved yourself your expense x your tax rate since HSA contributions are tax free.

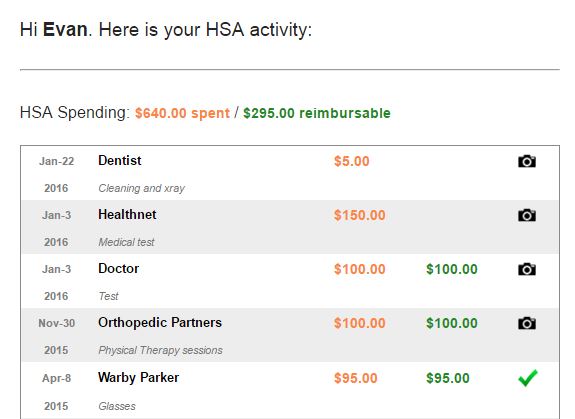

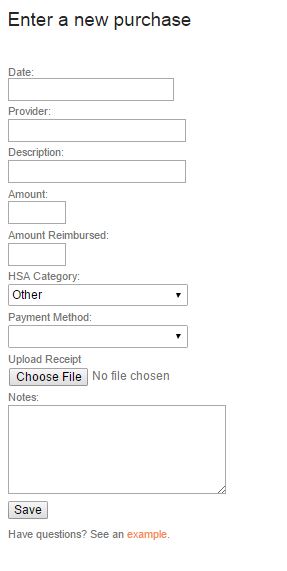

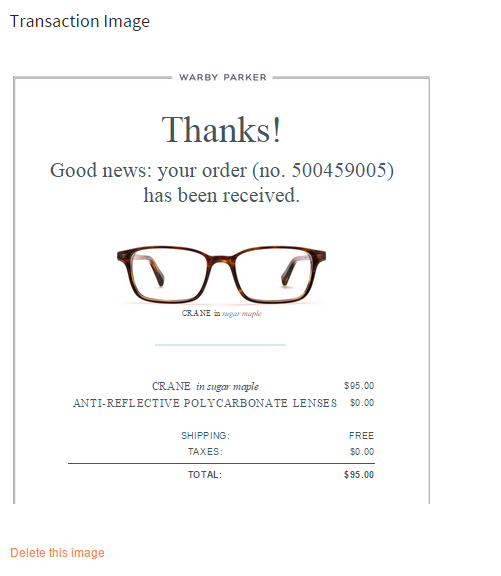

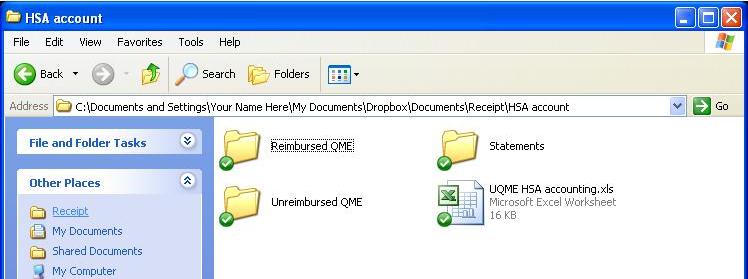

- Make qualified medical expenses using a non HSA account. This creates unreimbursed credits that you may withdraw in the future. That way, these monies may grow safely in the HSA tax free. See the article Using your HSA like an ATM.

- Withdraw your HSA account (not recommended). Unless you really need the money, you should not withdraw from your HSA for non-qualified medical spending. If you do so, you incur a

10%20% penalty against that money you withdraw. You can thank changes to HSA’s resulting from the ACA for that (see above), and this is quite a steep penalty indeed.