Update: There has been a lot of questions about Form 8889 and this is one of the most popular pages on the site. Knowing Form 8889 is a beast, I created EasyForm8889.com to fill it out for you. Just answer simple questions and in less than 10 minutes, you download a completed Form 8889 PDF. Hope you like it – thanks!

Overview

If you have an HSA account and have activity in it during the year, you are required to file IRS Form 8889, which is a tax form used to report HSA contributions, distributions and tax deductions. While this may sound like a pain, don’t worry, it isn’t too bad. Moreover, doing so insures that your contributions are tax exempt, a key part of the HSA’s triple tax advantage. It also prevents you from paying excessive penalties or taxes.

Here is a copy of IRS tax Form 8889 for 2015 so you can see what it looks like.

I have created the following video to walk you through Form 8889. In it, I provide explanations and examples for each section and line, so that you can file your Form 8889 with confidence. The transcription of the information is below.

Watch on Youtube: How to File HSA Tax Form 8889

Who is required to file Form 8889 for their Health Savings Account?

- You (or someone on your behalf, i.e. an employer) made contributions to your HSA during the year

- You received HSA distributions (cash transferred out) during the year

- You over contributed to your HSA, likely by using the Last Month Rule last year but violating the Testing Period.

- You acquired an HSA due to the death of the account beneficiary

What tax forms you will need

- IRS Form 5498-SA (contribution activity, provided by HSA custodian)

- W-2 Form (if your employer made HSA contributions)

- IRS Form 1099-SA (distribution activity, provided by HSA custodian)

- IRS Form 8889 and the Form 8889 Instructions (check that your tax software prompts you for HSA information)

How to fill out Tax Form 8889

Definitely view the Instructions for Form 8889 if you need help or have a complicated case. With those by your side, just go through each line one at a time and consider what it is asking. Populate that data before moving onto the next one. If you get stuck, check the Instructions or the above video for my advice.

If you are filing your taxes electronically, be sure to look out for any questions relating to HSA’s on the standard forms. Checking them correctly will trigger the software to include tax form 8889 automatically into your tax preparation so that you don’t miss it. If in doubt, search or call the company you are using.

In sum, the form is trying to establish 3 things:

- Amount of HSA Contribution

- Amount of HSA Distribution

- Total Income or Additional Tax Due

Let’s take a look now at each section and each line of Form 8889

Part I – Contributions and Deduction

This part of the form asks you to verify that you were covered under a high deductible health plan during the year in question, how much you and then your employer contributed, and calculates your contribution amount was for the year. This contribution amount is the actual amount you can deduct from your taxable income, so it is very important. This calculation occurs on Line 3 of Form 8889 and can be tricky, so pay attention there.

- Line 1 – Select a plan to indicate your coverage (Single or Family) for the year. If your plan changed during the year, choose the plan that was in effect the longest. You will square this up on Line 3, Contribution Limit.

- Line 2 – Your HSA contributions – see Form 5498-SA from your HSA custodian. Do not include employer contributions, those go in Line 9.

- Line 3 – Your contribution limit for the year – very important. If you had the same HSA eligible insurance for the full year, simply enter that contribution limit here (2015: single=$3,350, family=$6,650). If your insurance changed, you will use a pro rata methodology. See the instructions (and the Youtube video has a good example of this) but going by month, sum the yearly contribution limits for the year, then divide by 12. That is your contribution limit. If you joined an HSA this year, you can contribute the full amount under the Last Month Rule. However, you will have to maintain coverage into next year per the Testing Period or face a penalty.

- Line 4 – Archer MSA activity. For most people, this is $0. If you have an Archer MSA (an antiquated precursor to the HSA), see the instructions to populate this amount.

- Line 5 – Subtraction.

- Line 6 – If you and your spouse both have an HSA and are covered under a family plan, you can decide how to allocate the income tax deduction from your HSA. This may be beneficial for tax purposes in certain situation. If this applies to you, see the Instructions to calculate this amount.

- Line 7 – If you are 55 or older and have family coverage, you are eligible for additional contribution to your HSA above the limit. See instructions to determine this.

- Line 8 – Addition

- Line 9 – Your employer contribution to your HSA. If this is not on the form 5498-SA you received from your HSA provider, you can find it on box 12 of your W-2 marked with code “W”.

- Line 10 – This is rare, and a described line. For line 10, Qualified HSA funding distributions refers to distributions from IRA / Roth IRA accounts to your HSA. This does not mean distributions our of your HSA, say for qualified medical expenses. That will occur in Part II, line 14a.

- Line 11 – Addition

- Line 12 – Subtraction. This makes sense – notice how it is reducing your contribution limit by any amount that your employer contributed. This prevents you from having both a large personal and employer contribution, and enjoying all of that tax reduction / money from both.

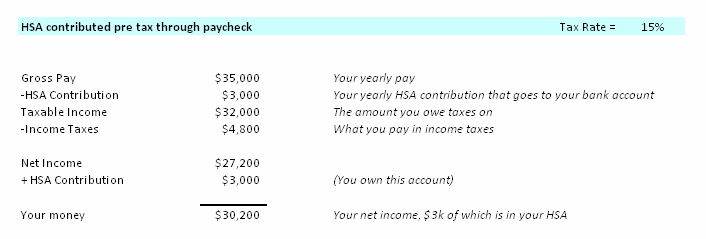

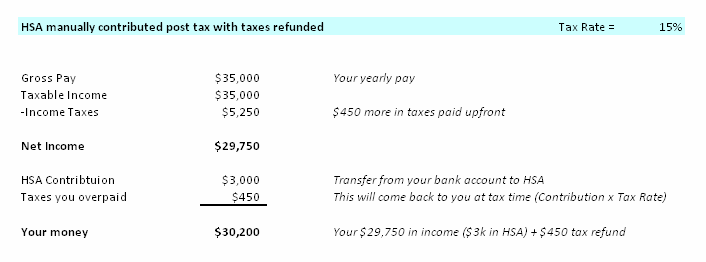

- Line 13 – Important – this is the actual amount you can deduct from your income per HSA tax law. This will make its way onto Form 1040, line 25, and is an important mechanism for how the HSA tax deduction works. By reducing your taxable income, the HSA allows you to pay less in taxes.

- Line 14 – Distributions from HSA

- a) These are funds you took out of your HSA during the year. This can occur in many forms – bank transfer to reimburse yourself, cash withdrawal from HSA, HSA debit card purchase, or check written against your HSA. All of these amounts need to be added up and included here. You can reference form 1099-SA for distribution activity.

- b) HSA rollovers – only if you physically received a check to deposit into another HSA account. Or if you over contributed for the year and then withdrew that money to true up. They will remove these amounts from line 14a since it does not truly count as a spent distribution.

- c) Subtraction

- Line 15 – Very important. Now that we know how much you removed from your HSA in 14c, the government wants to know how much of that was spent on qualified medical expenses. They do not ask for proof at the time you file taxes, but they will certainly audit this value if you are so lucky. Any amount greater than box 14c will be penalized.

This is why TrackHSA is so valuable – you can view your account and verify all activity that came from your HSA was legit. You can even upload receipts to back it up. So if Uncle Sam comes knocking for an audit, you can easily compile all information to defend yourself.

- Line 16 – This subtraction determines if you spent any HSA proceeds on non qualified medical expenses. If you get a positive number here, you are going to owe tax and penalty (20%, 17b) on it, so you should go back and reconsider what you are doing. This amount makes its way onto Form 1040 as “Other Income”, which will be taxed.

Another plug for TrackHSA. Say you spent more on qualified medical insurance than you distributed from your HSA. This is actually a smart move because you are allowing that money to stay in your HSA, invest and grow, instead of spending it. I call this amount “unreimbursed qualified medical expenses” and it puts you ahead of the game. Moreover, you can later distribute that money from your HSA should you need it. I call this “using your HSA as an ATM“. TrackHSA will maintain this purchase amount for your as “unreimbursed amount”, so that in the future you can reimburse yourself for it and populate it that year’s HSA tax form. TrackHSA let’s you substantiate it later on, proving it was legit.

- Line 17 – Penalty on excess distributions. If you have a positive # in Line 16 it means you mispent your HSA fund on non qualified medical expenses and the penalty occurs here.

- a) If you had a positive number in Line 16, you have one last change to avoid penalty if 1) you turned 65 2) became disabled or 3) the account holder died. See instructions for specifics.

- b) Penalty time. If nothing in 17a pertained to you, you have to pay a 20% penalty on your excess distributions from line 16. Not fun. This makes its way back to Form 1040 on line 62 as Other Taxes (read: penalty) from “HSA”.

- Line 18 – Uncommon – for most people this is $0. The naming here is very vague, but if you look at the instructions, this only applies if:

- In a previous tax year, you utilized the Last Month Rule AND

- Later ended your HSA insurance early, violating the Testing Period.

If this is the case, you in fact over contributed and will need to enter the excess amount you contributed from the Last Month Rule compared to if you hadn’t used it. In other words, by how much did you over contribute? For example, if you began insurance on July 1st and take advantage of the Last Month Rule for the year, you would benefit from an increased contribution limit of 6 months (Jan – Jun). In that case you would enter enter a number which equals 6/12 * Contribution Limit. See Form 8889 Instructions and the Line 3 worksheet to calculate if needed.

- Line 19 – Uncommon – for most people this is $0. This goes back to Line 10 where you enter the amount of any funding distribution from a IRA/Roth IRA going into your HSA. Whatever this is the government doesn’t like it, and is going to tax and penalize you on it..

- Line 20 – Here, you add up lines 18 + 19 and add this back as Other Income on Line 21 of Form 1040. This is not good because this amount is going to be taxed.

- Line 21 – To add insult to injury, not only does the government tax you on the amount of line 20, it penalized it by 10%. This amount makes its way to Form 1040 on Line 62 as “Other Taxes” (read: penalty) and you will have to pay this amount to the government.

Part II – Distributions

This part of the form looks at money you removed from the HSA and verified it was spent properly. If not, it assesses a penalty.

Part III – Taxes and Penalties from Last Month Rule

In this section, the form assesses additional taxes and penalties for 1) previously violating the Last Month Rule and 2) HSA funding Distribution from IRA/Roth IRA. These amounts will make their way to Form 1040 and be taxed (line 20) and penalized (line 21), so best to avoid this if possible.

Conclusion

So that is a lot of detail and a lot of information, but hopefully it makes filing Form 8889 much easier for you. In the end, just verify where amounts are flowing to Form 1040 and make sure where you want them to be (reducing Taxable Income) and not as as penalties (adding to Taxable Income or as Other Taxes).

————————————

Note: if you have an HSA, please consider using my service TrackHSA.com to manage your Health Savings Account. You can store purchases, receipts, and reimbursements securely online. Start for free today.