This post provides a summary of the main rules for HSA’s, for both their creation and use. Following these rules, you can understand 90% of what HSA’s are all about and avoid major pain points. Of course, due to the complicated nature of the IRS there exist corner cases you may encounter based on your situation, for which hopefully this site is a good resource.

Rule #1: You must have qualifying health insurance

You can only open a health savings account if you have a High Deductible Health Plan (HDHP). This is an IRS tax guideline, the definition of which changes each year based on inflation and other adjustments. Basically what this means is that HSA’s are an advantage only allowed to a certain subset of health insurance accounts that fall under the HDHP umbrella.

For 2017, the requirements that define HDHP insurance are below. Thus to open an HSA, your health insurance must conform to the following:

| Self Only Coverage | 2016 | 2017 |

| Maximum annual deductible for HDHP | $1,300 | $1,300 |

| Maximum annual out of pocket limit for HDHP | $6,550 | $6,550 |

| Maximum annual HSA contribution | $3,350 | $3,400 |

| Family Coverage | ||

| Maximum annual deductible for HDHP | $2,600 | $2,600 |

| Maximum annual out of pocket limit for HDHP | $13,100 | $13,100 |

| Maximum annual HSA contribution | $6,750 | $6,750 |

Note: besides having HSA eligible insurance, there are 3 other requirements for opening an HSA that you should be aware of but we not be covered here: 1) you cannot be enrolled in Medicare, 2) cannot be claimed as a dependent on someone else’s tax return, 3) do not have any other health insurance.

Rule #2: You must open a Health Savings Account

You must actually apply for an open an HSA account from the banking institution of your choice. Perhaps your employer helps you do this, or perhaps you open the HSA yourself. Either way, the Health Savings Account must be open before you can any expenses incurred qualify for payment from (future) HSA funds. Per IRS form 969 (2015 PDF):

You can (only) receive tax-free distributions from your HSA to pay or be reimbursed for qualified medical expenses you incur after you establish the HSA.

So the actual HSA contributions do not need to be in your account, but any medical costs you incur before opening the account are not qualified and cannot be paid with (tax free) HSA dollars.

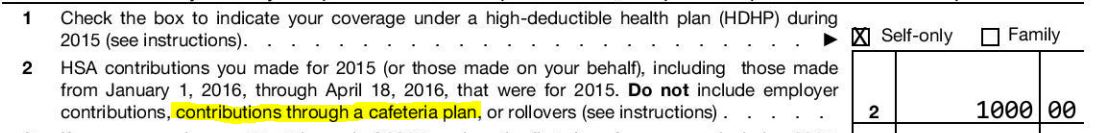

Rule #3: Know your HSA contribution limit for the year

There is a maximum amount you can contribute to your HSA each year called your contribution limit. This amount varies based on a number of factors that may apply to your situation. The simple case is if you had health insurance all year, the contribution limit for 2017 for self only insurance is $3,400 and for family insurance is $6,750. If you are 55 or older, you can add an additional $1,000 to that. If you are married and both have HSA’s, you have to share the $6,750.

If you had partial year coverage, more complicated rules apply. Generally a pro rata (by month) allocation of the contribution limit for your insurance occurs. If you began HSA coverage this year, you may take advantage of the Last Month Rule. This optionally allows you to contribute up to the contribution limit for the year, even if you had partial year coverage. However, do so with caution: if you fail to maintain the Testing Period, these contributions will be considered excessive and taxes and penalties attached.

Rule #4: Spend your HSA only on Qualified Medical Expenses

In order to receive tax benefits of HSA’s, you must play by the IRS’s rules regarding how they are spent. They detail these as Qualified Medical Expenses which include a wide variety of medical items such as prescription drugs, copay’s, doctor’s visits, dental work, eye care, child care, surgeries, tests, hospital fees, acupuncture, etc. For HSA contributions to be spent tax free, they must be spent on qualified medical expenses. If HSA funds are spent on anything other than qualified medical expenses, they will be taxed and penalized.

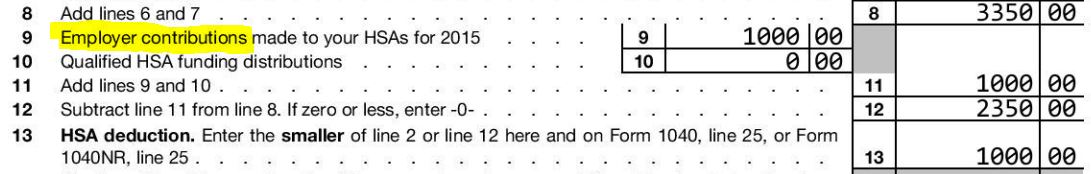

This tax/penalty calculation occurs when you file HSA tax Form 8889 for your yearly taxes, as you will be asked two questions regarding your HSA.

- How much was spent from your HSA during the year?

- How much was spent was spent on qualified medical expenses during the year?

Any difference noticed above (amount not spent on QME) will be taxed and penalized.

Rule #5: Record all of your HSA transactions

So how does the IRS know that you spent your HSA funds on qualified medical expenses? For one, they require that you maintain proof regarding all of your purchases made with your HSA. While they do not ask for it each year, they reserve the right to audit your HSA tax filings at any time. In this scenario, the burden is on you to substantiate all of your HSA spending for a given year(s). You are required to provide proof that the amounts you deducted for your HSA were spent entirely on qualified medical expenses, and likely show receipts that this spending occurred. Not being able to prove this could result in your HSA spending being reclassified as “non qualified” and taxes and penalties assessed.

There are a number of ways you can store this information, from the simple file or shoebox to the high tech excel file or custom website such as TrackHSA.com. Whatever method you choose, be sure that you maintain this information to protect yourself from the tax man.

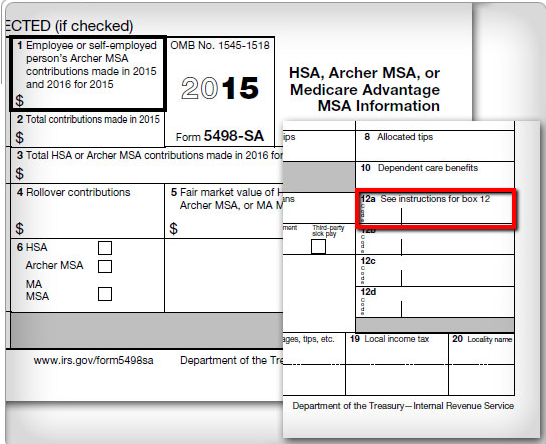

Rule #6: Account for your HSA taxes correctly

The best laid HSA plans are all for not if you file your taxes incorrectly. Imagine if you save in your HSA for years, use the funds correctly, and diligently record all of your medical expenses and maintain records. If this activity fails to make it to your 1040 tax form in the proper manner, it does not matter and the whole effort has been wasted. In this scenario, you will find yourself paying excessive taxes which could have been avoided.

Form 8889 is the crucial link to insure that the HSA’s tax advantages make there way to Form 1040 in the correct manner. I recommend the use of EasyForm8889.com to accurately complete your HSA tax form 8889, no matter what your HSA situation for the year. With Form 8889 being the main HSA input, the main output on Form 1040 will be your tax liability, which hopefully your HSA has helped reduce.