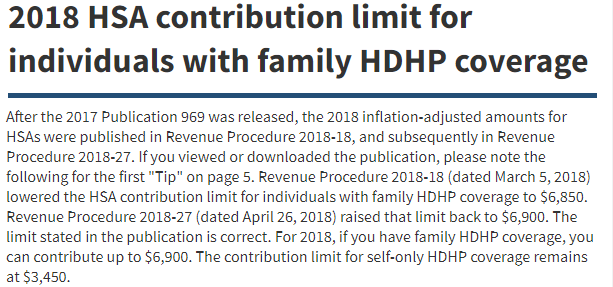

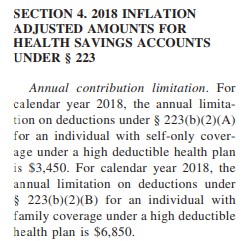

[Update May 2018: note that as of April 26th, 2018, the IRS has reversed course and reset the 2018 Family HSA limit to $6,900. This was the original amount that was decreased to $6,850 in March. See below for information on the decrease, and read on to hear the fury and toil it caused.]

Not in our wildest dreams did we consider this possible: the IRS has lowered the 2018 HSA Family Contribution Limit two and a half months into the tax year. Yes, you read that correctly. Previously, the 2018 Family Contribution limit for Health Savings Accounts was $6,900, and due to an inflation calculation change, this has been reduced by $50 to $6,850 as of March 5th, 2018. Fortunately, self-only and catch up contribution rates were unchanged.

This has come about as of IRS bulletin 2018-10:

Impact of the IRS HSA contribution change

Only the 2018 Family contribution limit has been affected, and while the inflation calculation may alter the course of future contribution limit increases, only 2018 is in play as we are mid year. It is not immediately clear what the total impact is for this change in contribution limit mid year. Obviously, HSA eligible individuals on family coverage will not be able to contribute as much this year. Here are the likely impacted parties:

- Family coverage that already contributed max – there are some “all star” HSA users that are fortunate enough to make full year HSA contributions at the beginning of the year. They often do this to get their money invested in the market to receive a return on their funds for the year. Those people (retroactively) have an excess contribution of $50 that they need to remove. It would be easiest to do this ASAP to avoid interest / gains on that money needding to be calculated and removed. Easy, no penalty process but an annoyance for $50 when you did everything right.

- Family coverage planning on contributing the max – if you set your 2018 contribution to $6,900 but haven’t fully contributed that amount yet, you are likely in good shape. Most HSA custodians will prevent you from making an excess contribution against the plan limits. When they update their plan limits, this equation will kick in, and likely prevent a problem once you get to $6,850 in contributed funds sometime this year (depending on your monthly contribution amount).

- IRS – the IRS will need to update all of their data regarding this maximum deductible amount for 2018. Obviously, they didn’t see this as a big issue as they proceeded with the change mid year.

- HSA Plan Custodians and Insurance companies – there is much work to be done by HSA custodians and insurance companies. Every single custodian and plan that administers HSA’s is now out of whack, thanks to a minor $50 change. All of their programs, banking software, websites, and literature needs to be updated. This will need to be corrected, and the sum effort (and cost) for all of these entities is massive.

- HSA websites – same goes for everyone sharing and publishing information about HSA’s. All of the previously published information is out of date and needs to be updated.

I will leave it to our fine readers to decide for themselves whether this mid year change for $50 was value added, intelligent, or warranted.

Why the IRS reduced the 2018 HSA Family limit

As part of the Trump tax cuts, legislation was passed that changes how inflation increases are calculated. In essence this is a net negative as the traditional CPI has been replaced with the “chained” CPI, which is different as it allows substitutions of products in the CPI basket of goods. This “substitution” effect is a classic economist assumption that means that if beef prices are rising, consumers avoid it and buy chicken instead. Beef is thus less represented in the index, meaning that total inflation is shown as lower than using the regular CPI. This will result in lower cost of living increases across the board going forward. While this is a negative, the real mistake was implementing it for 2018, and not waiting for a fresh tax year.

For those following along at home, here is the text on the section changing the CPI calculation:

.03 Section 11002 of the Act amends § 1f(3) to provide a permanent cost-of living adjustment based on the Chained Consumer Price Index for All Urban Consumers (C-CPI-U). Any existing items that are not reset for 2018 will be adjusted for inflation after 2017 based on the C-CPI-U. Items that are reset for 2018 will be adjusted for inflation after 2018 based on the C-CPI-U

All in all, a moderate sized change that creates a lot more work for many.