This question was submitted by HSA Edge reader Adam. Feel free to send in your question today to evan@hsaedge.com.

I have had an HSA for 7 years and have a balance of $7k in the account. If I need to access this money for non medical expenses, what are the penalties I will pay? What are the income taxes, do I pay a taxes on the penalty, and how do I pay this?

Withdrawing Funds from an HSA

Contributions to Health Savings Accounts are intended to be used for qualified medical expenses. If used in this manner, they offer a triple tax advantage that saves you money by decreasing your taxes. However, life presents a lot of challenges, and sometimes you need to access and use your HSA money for other things. In IRS speak, this is called a non-qualified withdrawal, and basically means taking out HSA money for non medical use. This could be anything from a bike, to a vacation, to home appliances. The point is that you need to declare this usage of money since it isn’t abiding by the HSA rules. While the IRS let’s you get your money out, the drawback is you will owe taxes and penalties on this withdrawal.

Before taking a penalty hit, be sure to review all the ways to cash out your HSA. Perhaps you can get creative and avoid taxes and penalty.

Non Qualified Withdrawal – Tax Calculation

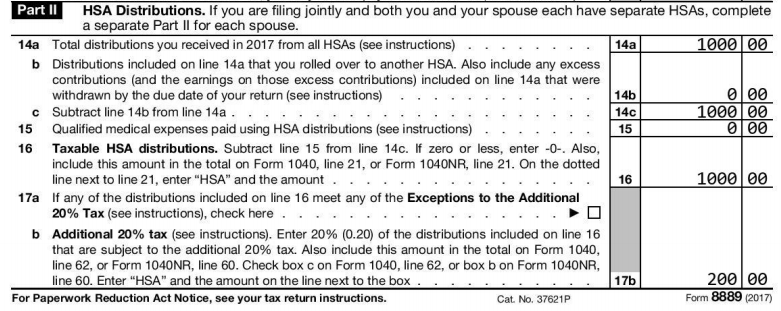

First up, you are going to need to pay taxes on your withdrawal. This is reasonable since the funds you contributed were tax free – you got a tax deduction when you contributed them. That tax deduction was predicated on the funds being used for medical purposes, and since that is not the case, it seems fair to pay that tax benefit back. This calculation first occurs on Line 16 of Form 8889. Here, you take you total HSA distributions (Line 14, net) and subtract qualified HSA distributions (Line 15). The result is non qualified distributions, Line 16, also called “Taxable HSA Distributions”. This amount will make its way Form 1040 and be added to income, thus increasing your taxable income for the year. This will either increase your taxes owed or reduce any tax refund.

2017 Form 8889 created using EasyForm8889.com

The actual amount of income taxes you will pay is determined by your marginal tax bracket. The US income tax system is progressive meaning it consists of increasing tax rates in brackets, which are ranges of income amounts. The result is each additional dollar you earn is taxed at your highest rate. For example, if you make a non qualified distribution of $1,000 and are in the 25% tax bracket, you show that extra $1,000 as income and will owe taxes of $250. Note that this marginal tax rate differs from your average tax rate for the year, which is a weighted average of your income in various tax brackets.

Non Qualified Withdrawal – Penalty Calculation

After the taxes, the bad stuff starts happening. Most unfortunately, the IRS penalizes non-qualified withdrawals a whopping 20%. This means that besides taxes, for every $1,000 you take out of your HSA for non medical expenses, you will owe a fee of $200. That is an expensive price to pay to get your money, but sometimes it is worth it.

Back on Form 8889, Line 17b multiplies that “Taxable HSA Distribution” amount by 0.2, i.e. 20%. The result is the amount of penalty you will have to pay to the IRS. This amount makes its way to Form 1040 Line 62 where it is added as a penalty in the form of an additional amount due for the year.

The good news is you do not pay taxes on the penalty amount. As you can see above, the tax amount was calculated and then the penalty amount was determined. Said another way, the penalty calculation is a function of the taxes due, not the other way around. In terms of when this payment must occur, note that all HSA penalties and taxes are payable when you file taxes in the year the non-qualified distribution occurs. This is almost always in the future, so you have until April of the following year to find that tax and penalty amount and pay it to the tax man.

Note: if you have non qualified withdrawals this year, please consider using my service EasyForm8889.com to help complete Form 8889. It is fast and painless, no matter how complicated your HSA situation.