Qualifying for an HSA

The IRS defines eligibility for contributing to a Health Savings Account. They group these requirements into the term “eligible individual”, and if one is an eligible individual, than they can open and contribute to a Health Savings Account. However, some of the requirements of an eligible individual change from year to year, specifically the definition of a High Deductible Health Plan (HDHP). It is important to know if you are an eligible individual because it determines your contribution limit for that month, and hence, the year. You need to proactively monitor changes in these definitions, especially if your health care coverage changes. Making contributions when you are not an eligible individual can lead to penalties via excess contributions.

HSA eligibility determined monthly

Your status as an eligible individual is determined by the IRS at the beginning of each month. They do not do this for you, but instead rely on you to know the rules and proceed as appropriate. Doing this incorrectly can cost you money, either through excess contributions or not contributing enough.

Practically, this means that throughout the year, on the first day of the month you need to test against the 4 requirements of an eligible individual. This is easier than it sounds: if you were an eligible individual the month prior, and nothing changed regarding your insurance, you are likely an eligible individual the next month. The one exception here is at the beginning of the year as HDHP definitions can change, causing your plan to no longer fit the definitions for an HSA.

The requirements for being an eligible individual are a package deal. If you do not meet any one of them, you are not an eligible individual, so you can’t contribute to an HSA that month. On the other hand, if you are an eligible individual at the beginning of the month, that eligibility lasts for the entire month. This means is you can contribute to your HSA for that month i.e. 1/12 of your contribution limit.

Your status as an eligible individual may change throughout the year. Since you are “tested” each month on the 1st, the result may come back differently. You may be an eligible individual for January – June, ineligible for July – November, and eligible in December again. This would effect the calculation for your contribution limit for the year. You can also look back over the year and determine if you were an eligible individual for each month, generally by looking at the insurance you had on the 1st.

What follows is a discussion of the 4 requirements that define an eligible individual for an HSA. All of this can be found in IRS Publication 969.

1) Covered by HDHP

This is the big one that makes or breaks it for most people. Your health insurance must meet certain criteria to be considered a High Deductible Health Plan. If it does, you have met 1 of the requirements for being an eligible individual. If it does not, you are not allowed to contribute to an HSA during that time.

You must be covered under a high deductible health plan (HDHP), described later, on the first day of the month.

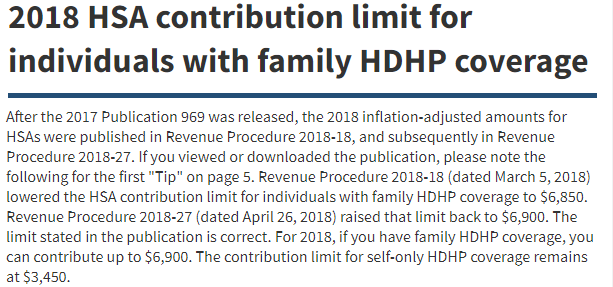

For both self-only and family coverage, the IRS sets minimum deductibles and maximum out-of-pocket amounts. Your plan must have a higher deductible and lower maximum out of pocket amount to be considered an HDHP. You can find contribution limits and HDHP definitions on the sidebar of this post.

These are generally straightforward but you need to be careful when you change coverage or the year turns over. These amounts change from year to year, and unfortunately, what is an HDHP one year may not be one the next.

2) No Other Health Coverage

You cannot have other health insurance and be considered an eligible individual. For example, you cannot be on both an HDHP and a spouse’s plan at the same time. Of course you can do this if you want, but you will not be able to contribute to an HSA.

You have no other health coverage except what is permitted under “Other Health Coverage”, later.

The exceptions that the IRS lists under “Other Health Coverage” include limited purpose FSA or HSA (not regular FSA’s that you are thinking of), Suspended HRA’s, post deductible FSA and HRA, and retirement HRA’s.

3) You are not enrolled in Medicare.

This one seems pretty straightforward: if you are enrolled in Medicare, you are not eligible for contributing to an HSA for that month. Most people stay on Medicare once they join it, so at that point they are done contributing to their HSA. Of course, you still get to enjoy your existing HSA contributions, and once you are 65, you can enjoy them for non-medical expenses. A nice boost to retirement, if you will.

However, the risk you run with Medicare is that it retroactively applies coverage in a weird way. If you apply for Medicare after you turn 65, its coverage retroactively applies up to the 6 months prior. The result is you are disqualified as an eligible individual for those months, and you risk excess contributions for that time.

4) You are not a dependent

This one is pretty straightforward, you cannot be a dependent on someone else’s tax return and contribute to your own HSA.

You cannot be claimed as a dependent on someone else’s tax return.

However, if you are not a dependent but still on a parent’s plan, you can still contribute to an HSA. This is common for adult children on a parent’s HSA plan – and they can contribute the family limit in their own account!

Eligible Individual using the Last Month Rule

The one override for being an eligible individual is the Last Month Rule, which can grant eligible individual status to months prior to you being insured. It is often uses when you begin HSA eligible insurance, but if you have HDHP eligible coverage on December 1st, it allows you to be an eligible individual for up to the full year.

Under the last-month rule, you are considered to be an eligible individual for the entire year if you are an eligible individual on the first day of the last month of your tax year (December 1 for most taxpayers).

This has the effect of allowing you to contribute the full contribution limit, even if you didn’t have HSA insurance for the full year. However, there is a catch, and it is you must maintain that coverage for the following 12 months by means of the Testing Period. If you don’t, you can owe taxes and penalties on the amount you “over” contributed. You do not need to use the Last Month Rule, and instead can play it safe by contributing the percentage of the contribution limit for months you were covered.

————————————

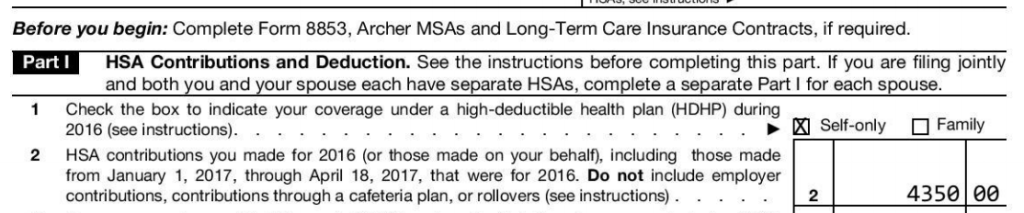

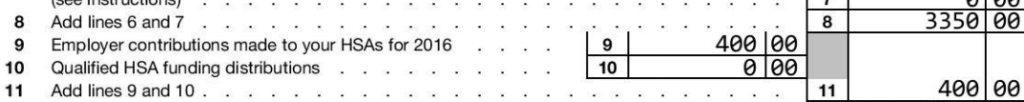

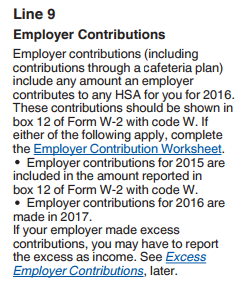

Note: if you need help determining your HSA contribution limit based on being an eligible individual or not, please consider using my service EasyForm8889.com to complete Form 8889. It asks simple questions to determine this for you, no matter how complicated your HSA situation.