This question was submitted by HSA Edge reader Steve. Feel free to send in your question today to evan@hsaedge.com.

I will be age 55 on 12/4/18 and have single-person HSA coverage. Must I wait until I am actually 55 in December to make the $1,000 extra contribution, or can I begin making monthly contributions now and throughout the rest of 2018 that total an extra $1,000? My employer won’t allow extra contributions until I am actually 55 on 12/4/18.

Making an HSA 55+ Catch Up Contribution

Health Savings Accounts have a great feature for those 55 and older that allows you to contribute an additional amount each year, currently set at $1,000. This extra amount is added to your self-only or family contribution limit, which allows you to contribute your self only or family amount, plus the additional $1,000 each year. We like this because it lets you contribute more money to your HSA. Now, this assumes that you did not end coverage during the year, in which case the self-only and catch up contribution are pro-rated for the months you had coverage. Either way, it is a great way to get some extra funds into your HSA.

The question at hand is one of timing. Can you make the 55+ contribution any time during the year you turn 55? Or, if you are not yet 55, do you need to wait until your 55th birthday to actually make the 55+ contribution? If the latter was the case, that leaves Steve with only 2 weeks before the end of the year to make that contribution. Moreover, his employer is telling him he needs to wait until this time to make the contribution. How do they track and enforce that? For example, if I am contributing 1/12 of my limit per year, including the $1000, I am “under” contributed for about the first 10 months of the year.

55+ Contribution Can Be Made Anytime During Year

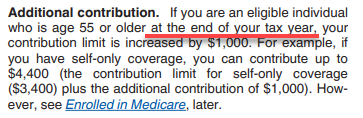

Luckily, the IRS opines on this matter indirectly in Form 969 and it is favoriable to the consumer:

Here, the IRS states that the eligible individual who is 55 or older by the end of the tax year has their contribution limit increased. Remember that HSA contribution limits are per year, so you only have 1 contribution limit for a given year. Generally, you can determine that limit on January 1st (barring any change in coverage). Contrary to what Steve’s employer states, the IRS does not say that the catch up contribution limit is only increased pro rata by age, or only applies once the person actually turns 55, or can only be contributed to once the person is 55. It simply states that if you will be 55 during the calendar year, your contribution limit is increased. Thus, the reality is you can make that contribution whenever you see fit.

In Steve’s case, he will be 55 in December at the end of 2018. Thus, his 2018 contribution limit is increased for the entire year. That means that he can begin contributing his 55+ contribution as early as January 1st, 2018. He does not need to wait until he is actually 55 to make that catch up contribution.

I advised Steve to take this up with his employer and HSA custodian. While an employer can create any rules they wish, this is likely a simple oversight of how HSA plans function. Hopefully they can change this to align with how HSA’s work and make it easy on people like Steve who have late birthdays. It also allows people to gain the benefits of front loading their HSA contributions early in the year.

Note: if you need help accounting for your 55+ contributions on your HSA taxes, please consider using my service EasyForm8889.com to complete Form 8889. It is fast and painless, no matter how complicated your HSA situation.