This question was submitted by an HSA Edge reader Mordechai. Feel free to send in your question today to evan@hsaedge.com.

My family insurance plan (parents and children), besides having a total deductible and out of pocket max for the entire plan, has a separate deductible and OOP max for each individual on the plan. Do these numbers effect my eligibility for an HSA?

Family vs. Individual Deductibles

A deductible is an amount you pay out of pocket before insurance begins paying. Most family coverage HSA plans feature an aggregate (“non-embedded”) deductible with one deductible amount for the entire family. Each individual’s medical spending counts toward that deductible, and once met, insurance coverage begins. The only thing that matters is whether the deductible is met, not who spent what towards it. This means that one person can incur enough cost to trigger the deductible, or it can be a shared effort. Either way, it is irrelevant since there is one deductible and it is shared.

Some HSA eligible HDHP insurance plans include individual deductibles in addition to the family deductibles. These plans are quoted as “deductible of $4,000, individual deductible of $2,800”. Each individual’s expenses count towards their individual deductible as well as the family deductible. Once they have met their individual deductible for the year, insurance begins paying expenses for that individual. Once the family deductible is met for the year, insurance begins paying for the entire family.

The benefit of an individual deductible is they are lower than family deductibles, so you can receive full cost coverage sooner. The downside is that coverage only applies to one person until the family deductible is met. In addition, it is another deductible to manage for each person insured.

How Individual Deductibles Work with Health Savings Accounts

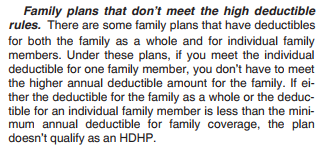

When evaluating HDHP plans for HSA eligibility, it is important to keep in mind how individual deductibles come into play. The IRS states that for a plan to be HSA eligible, both the family and individual deductible must be above the minimum annual deductible for HDHPs. If not, the plan is not considered a HDHP and is not HSA eligible. Per IRS form 969:

Said another way, if any of the individual deductibles are lower than the HDHP minimum deductible ($2,700 in 2018) the entire plan is not HSA eligible. This is true even if the plan’s “total” or family deductible is above the HDHP minimum. I don’t really like this rule as it is a grey area and confusing to users. That said, I understand its use since parts of the plan have a lower deductible than that required for HSA’s. The problem I have is this may not be apparent when choosing coverage, leading to a situation where someone plans and saves in their HSA, only to find they are not allowed to contribute.

Note: to fulfill the IRS requirement of tracking HSA receipts, please consider my service TrackHSA.com for your Health Savings Account record keeping. You can store purchases, upload receipts, and record reimbursements securely online.