This question was submitted by HSA Edge reader Lillian. Feel free to send in your question today to evan@hsaedge.com.

I used to have an HSA account through my job but they are not offering that plan anymore, so now I have to pay a fee to keep that account open. Can I transfer that money to another account or another HSA bank where they would not charge me a fee even though my employer doesn’t offer that type of account?

Too many HSA fees

While Health Savings Accounts are a forward thinking way to save money and reduce medical expenses, the banks that provide the actual accounts have not fully caught up with the times. Their offerings suffer from poor web design, lack of tools and features, and restrictive / excessive fees. Even though HSA usage continues to increase at a rapid rate, traditional banks have not yet caught up, and avoiding fees for the HSA owner is an important part of protecting your investment. This article will review some commonly levied fees by one HSA custodian, and discuss 5 ways that you can reduce or eliminate HSA fees in your account.

Research fees structure before opening account

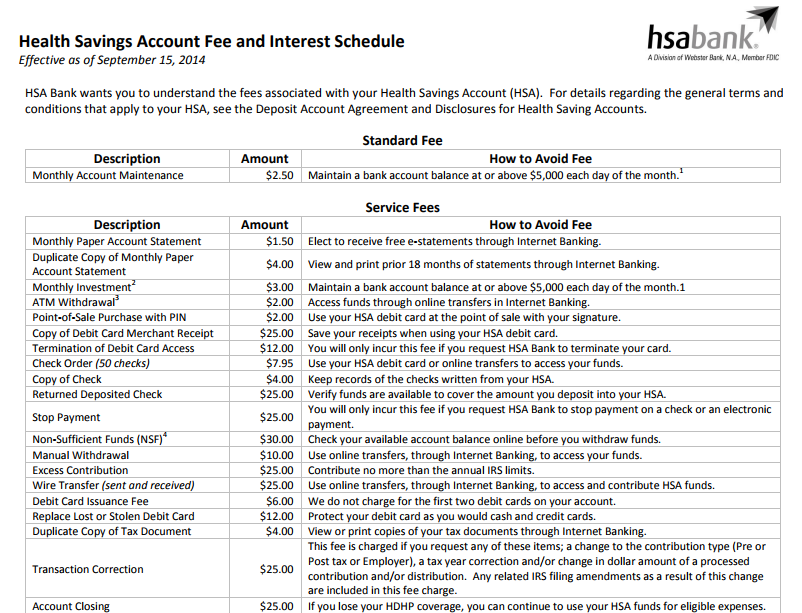

It is surprising how many fees there are related to HSA’s. Not just those specifically relating to your Health Savings Account, but other banking fees thrown in as well. For example, take a look at this screenshot from HSA Bank’s website describing some of their fees:

Granted, not all of these fees occur each month, and some of these are legitimate as they support costs for services. I do like how they list strategies on how to avoid the fee. However, as an HSA owner you need to look for recurring or transaction fees that affect your HSA. For example, here are some of the HSA related fees charged by that bank that directly affect HSA owners, some on every transaction!

- ATM Withdrawal

- Purchase using debit card

- Manual withdrawal

- Excess Contribution

- Invest your HSA (monthly fee)

- Account closing

While this bank is free to offer services they see fit, I hate being charged to access my money, so I see some of these fees as egregious and would shop around.

How to avoid HSA fees

Too many fees can add up and reduce your HSA balance over time. Plus, they are just annoying, since it is your money, and you are being nickel and dimed at every turn. As such here are some strategies to avoid or reduce Health Savings Account fees and charges.

- Choose low fee plans – this involves doing a bit of research before you open your HSA. While the timing of opening your HSA is important, it is also important to get the best deal possible. Search around online and talk to your bank / credit union to see what types of plans they offer. Somewhere hidden on their website is the fee schedule that you need to review. Apply those fees to your situation and compare the plans of different providers. This will insure that you are at least aware of the fees charged and can choose what is best for you.

- Switch HSA custodians – if you already have a Health Savings Account, you can still compare plans and switch to a new custodian if you find a better deal. This is easily done using an HSA Rollover to move funds between HSA accounts. Yes, you can have more than one HSA open at a time at different providers, and there is no tax or penalty to move HSA dollars between them. The point is you don’t have to stick with the HSA custodian your job set you up with, or the custodian where you first opened your account. Instead, do your fee research, find the best deal for you, and make a move if it makes sense.

- Maintain the minimum balance – one of the best parts about HSA’s is you can invest your funds tax free. However, many banks have a minimum amount needed to invest, and others levy fees if you are investing but your investment amount is under a certain minimum. Thus, if you can beef up your HSA and meet those minimums investment amounts, the monthly fees will go away forever. This might involve making an extra contribution or two to your HSA, or waiting to invest it until you have the minimum available. I recommend keeping part of your HSA in cash (not invested) at all times in case you need it for health care. Once you have that amount set aside, you can begin investing the rest.

- Choose cheapest options –if you look at the fee schedule above, you can see that they offer recommendations of how to avoid their HSA fees. Use this to your advantage by making choices that reduce fees charged. For example, there are a number of ways to pay for an HSA purchase. At the above bank, the associated fees are:

- ATM Withdrawal – $2

- Debit card purchase – $2

- Manual withdrawal – $10

- Online transfer – $0

Thus, it would make the most sense to purchase HSA elgible expenses on your credit card, and do an online transfer from HSA to bank to reimburse the purchase, making it tax deductible. Playing by the bank’s rules can add up and save you a lot of money over time.

- Play by the rules –regardless of your bank fees, you want to be familiar with the rules of HSA’s. This will help you avoid taxes and penalties with the IRS as well as your HSA custodian. For example, excess contributions can usually be removed from your HSA before tax day without penalty. However, the HSA custodian above will charge you $25 for the pleasure. In addition, they charge $25 for a transaction correction, which consists of a change to the transaction type, amount, or tax year. By knowing what you can contribute and getting it done correctly the first time, you can avoid this $25 fee.

Note: if you need help reducing HSA bank fees, consider my service TrackHSA.com for your Health Savings Account record keeping. You can store purchases, upload receipts, and record reimbursements securely online. Besides tracking everything important, this will help you batch transactions for reimbursement and prevent mistakes that cost you money.