Overview

This is a fairly common question I get from readers regarding the HSA’s Last Month Rule and how to file Line 18 on Form 8889. The question usually takes the form of:

- “Did I use the Last Month Rule last year?”

- “Do I owe anything for the Last Month Rule?”

- “What should I put on Line 18 of Form 8889 where it says Last Month Rule?”

Luckily, it should be easy to figure out whether the Last Month Rule even applies to your tax return. The goal of this article is to explain how the Last Month Rule works, and then ask 3 questions to see how it applies to you.

What is the Last Month Rule?

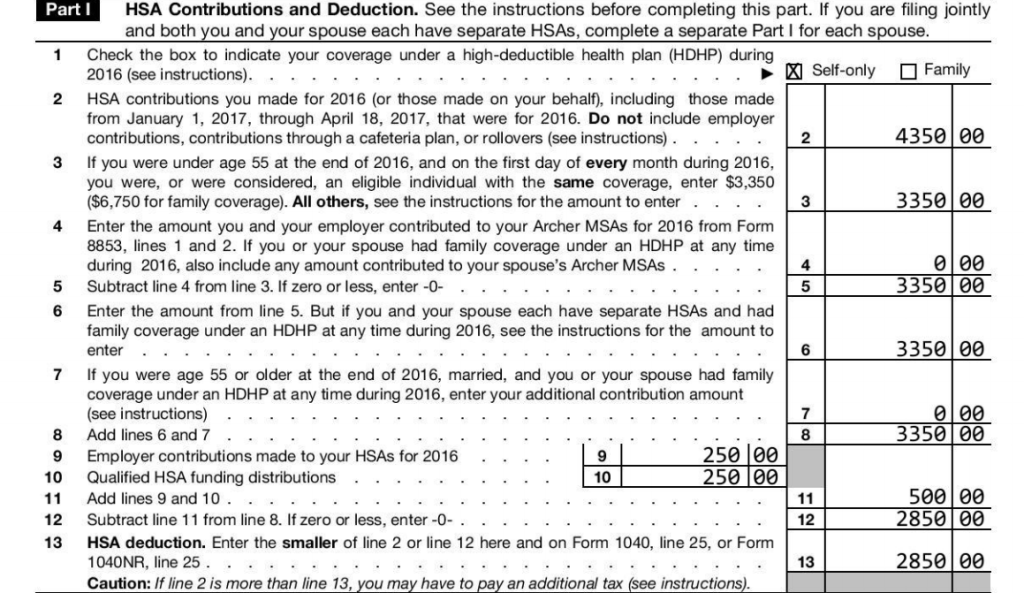

Let’s start by defining some terms. The Last Month Rule is a “feature” of HSA’s that generally only applies to a year that you begin HSA eligible coverage. It states that if you are an eligible individual as of December 1st of a year, you are treated as an eligible individual for that entire year. This is a benefit as it allows you the option to contribute that year’s full contribution limit instead of a pro-rata amount. You get more tax free medical spending.

As an example, assume I began coverage on June 1st, 2016. Normally, I would only be able to contribute 7/12 (Jun, Jul, Aug, Sep, Oct, Nov, Dec) or just over half of the contribution limit for that year. But since I had coverage on December 1st, I am treated as an eligible individual for the whole year and may contribute up to the full contribution limit.

What is the Testing Period?

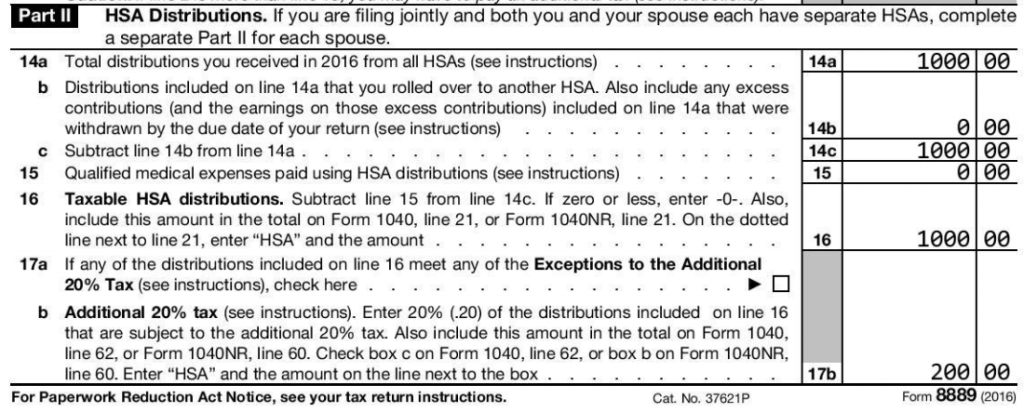

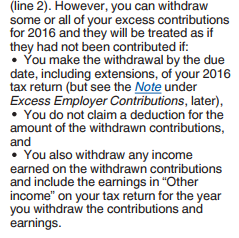

However, there is a catch. If you take advantage of the Last Month Rule and choose to contribute more than you normally could have (e.g. 12/12 vs 7/12 above), you are bound by the Testing Period to maintain that coverage for the following year. If you do not, any contribution above the 7/12 you were allowed is considered excessive and taxed and penalized on Line 18 of Form 8889 when you file your taxes. This is generally not good and should be avoided.

Please see this article for a more complete description of the Last Month Rule and Testing Period.

Determining if the Last Month Rule applies to you

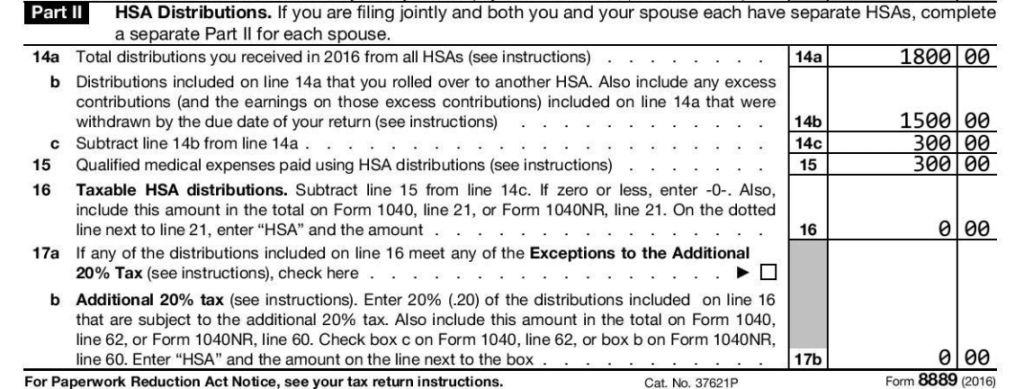

First off, let’s relieve a lot of people from worry: if you had the same HSA coverage for each month in a tax year, you can put “0” on Line 18 of Form 8889. Since the Last Month Rule applies only to those who began or changed coverage, you can ignore it and likely go onto something else more enjoyable.

If you had consistent HSA eligible insurance for each month of the year, the Last Month Rule does not apply and you can put “0” on Line 18 of Form 8889.

On the other hand, if you began or changed HSA coverage this year, let’s pose three “yes” or “no” questions to help determine if the Last Month Rule applies to you. You must answer “yes” to the following 3 questions to be eligible to use the Last Month Rule. Answering “no” to any of the following means you can only contribute the pro-rata contribution amount for the months you were HSA eligible.

1) Were you an eligible individual (have HSA eligible coverage) on December 1st of the tax year?

Answering “no” precludes you from using the Last Month Rule as it is a base requirement. This rules out people who, for example, had coverage from January – November of a year, or had coverage from February until August of a tax year. You at least have to have coverage in December to be eligible for the Last Month Rule.

If you answered “yes”, then you may be eligible to use the Last Month Rule, read on.

2) You were HSA eligible (had HSA coverage) for only part of the year?

Answering “no” means you had coverage for the full year, so by definition you can already contribute the HSA maximum contribution limit. You had coverage for 12 months, so can contribute 12/12 or 100% of the contribution limit for the year. You don’t need the Last Month Rule’s help. If this applies to you, put “0” on line 18 of Form 8889.

If you answered “yes”, you likely began coverage mid-year. Perhaps you got a new job and had HSA qualified starting on April 1st, so 9/12 months of the year. Or you had coverage for January through April, then stopped, then had coverage for November and December. If this sounds like your situation, this means that you have the option of using the Last Month Rule for that year. To actually use it, move on to question #3.

3) Did you contribute more than you would otherwise be allowed?

Answering “no” means you contributed less than or equal to your contribution limit based on your months as an eligible individual. So if you had HSA coverage for 5 months, you are allowed to contribute up to 5/12 (41.6%) of the contribution limit without using the Last Month Rule. Doing so plays it safe and avoids any of the requirements or risk of penalty associated with the Testing Period.

Answering “yes” sounds like, “I had HSA coverage for 7/12 months but I contributed the maximum contribution limit using the Last Month Rule”, or “I had coverage for 3/12 months (Oct / Nov / Dec or 25%) but contributed 1/2 (50%) of the maximum contribution limit.” In both of these scenarios, you contributed more to your HSA than you would generally be allowed. This is allowable, as you leveraged the Last Month Rule to make an increased contribution, but remember it has strings attached.

Conclusion

If you answered “No” to any of the 3 questions above, you cannot use the Last Month Rule. You will need to contribute your pro-rata contribution limit based on the number of months you were HSA eligible. You can also put “0” on Line 18 of Form 8889.

If you answered “Yes” to all 3 questions above, you used the Last Month Rule and contributed more than you generally could have. This is allowable but remember you need to maintain HSA coverage for the next year due to the Testing Period. For the current year, you can put 0 on Line 18. If you maintain that HSA coverage through the following year, you will also put “0” on Line 18 of that year’s Form 8889, pass the Testing Period, and hopefully never worry about the Last Month Rule again. Only if you don’t maintain coverage (i.e. fail the Testing Period) will you need to calculate a penalty for Line 18, which will increase your taxable income and add a penalty to your 1040 return.

Note: if this is super confusing, please consider using my service EasyForm8889.com to complete Form 8889. It asks these questions in a straightforward way and will generate your HSA tax forms in 10 minutes. It is fast and painless, no matter how complicated your HSA situation.