Overview

The IRS defines a maximum amount that you can contribute to your Health Savings Account each year, appropriately called the HSA Contribution Limit. This amount varies each year (adjusted for inflation) and is impacted by your age, type of insurance, and length of coverage during the year (see: 2017 HSA Contribution Limits). You cannot legally contribute more than the HSA Contribution Limit, but what if you accidentally do? These are called Excess Contributions and they can lead to penalties, paperwork, and headache. We will show you how to remove or apply personal and employer excess contributions and avoid penalty.

What are HSA Excess Contributions?

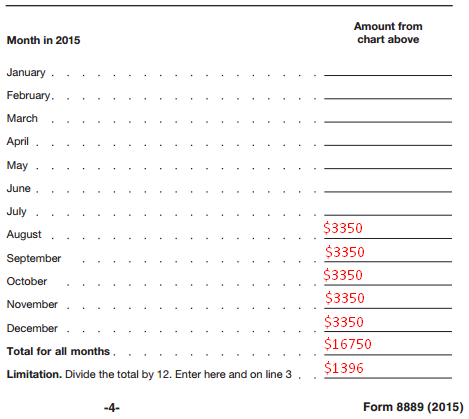

By definition, an excess contribution results when you over contribute to your HSA for the year. But what is over contribute? The first step is defining your contribution limit for the year. The IRS defines HSA contribution limits by type of insurance coverage: Self-only or Family. For 2017, these amounts are $3,400 and $6,750, respectively. You can also contribute $1,000 more if you are over 55 per the Catch-Up Contribution. These totals assume full year coverage, and your contribution limit is reduced proportionately for partial year coverage.

Once you know how much you can legally contribute, the second step is determining the amount you actually contributed to your HSA. While this sounds simple, there are multiple sources to consider here. When calculating excess contributions, the IRS defines your HSA contributions as:

Amounts contributed for the year include contributions by you, your employer, and any other person. They also include any qualified HSA funding distribution made to your HSA. Any excess contribution remaining at the end of a tax year is subject to the excise tax.

If your HSA contributions exceed your contribution limit, you have an excess contribution. Knowing this value will be key for rectifying the discrepancy.

Why This Happens

There are a few common scenarios that result in Excess Contributions, given the various factors that determine your contribution limit on Form 8889. Here are the most common situations that can lead you to over contributing:

- Too many contributions – This is just a simple technical issue of too much money going into your account, likely due to a math error or unexpected contribution. For example, if your contribution limit was $3,400, and each month you contributed $300 to your HSA, you would contribute $3,600 for the year. This leaves $200 in excess that needs to be removed.

- Employer contributions – A similar scenario occurs with employer contributions to an HSA. Granted you are quite lucky but perhaps it is unclear how much they will contribute. Or your employer contributes a variable amount based on some factor. Either way, employer contributions count toward your maximum HSA contribution so these must be included in a calculation of Excess Contributions.

- Miscalculated your contribution limit – This is the most subtle (and painful) way to over contribute. In this example, you assumed you were allowed to contribute $3,400 to your HSA this year, which you did. You find out that you were only an eligible individual for 10 months, so your contribution limit is really 10/12ths of your max contribution limit. Or, you front loaded your HSA contributions early in the year and then lost HSA eligible insurance. In either case, there is too much in your HSA for the year and you need to remove it.

Excise Tax

The government imposes penalties if you over contribute to your HSA. Per the IRS guidelines:

Generally, you must pay a 6% excise tax on excess contributions. See Form 5329, Additional Taxes on Qualified Plans (including IRAs) and Other Tax-Favored Accounts, to figure the excise tax. The excise tax applies to each tax year the excess contribution remains in the account.

So a few important points here. The penalty rate is 6% on the amount of calculated excess contributions. Not sure how 6% was determined but it is very close to an expected rate of return in the market. Either way, the kicker is you must pay this penalty each year the excess contributions remain in your account. So this is the gift that keeps on giving and you must rectify anything over contributed to avoid tax and penalty.

How to Correct Excess Contributions

Luckily, the IRS is lenient on fixing excess HSA contributions. They provide two options of correction: removal or future application. The first removes the HSA contributions in the tax year and avoids a penalty – no harm, no foul. The second “let’s them ride” in the account where they can be applied to a future year’s contribution, but incurs a penalty each year. We will walk through both scenarios below.

Option 1: Remove in the Current Year

This is probably the preferred option. If you catch your mistake before you file your taxes, you can avoid all penalties by removing the excess contributions (and any of their earnings) from your HSA and treating them as normal taxable income. Per the IRS:

You may withdraw some or all of the excess contributions and not pay the excise tax on the amount withdrawn if you meet the following conditions.

1) You withdraw the excess contributions by the due date, including extensions, of your tax return for the year the contributions were made.

2) You withdraw any income earned on the withdrawn contributions and include the earnings in “Other income” on your tax return for the year you withdraw the contributions and earnings.

The IRS spells it out pretty clearly there, but the removal of the excess contributions and the earnings on those excess contributions must occur before your tax due date. The removed is taxable since HSA tax benefits do not apply. Earnings on excess contributions occur if your HSA is invested or earning interest. Removing those seems fair, since those investments shouldn’t have been made in the first place. The IRS solves all of this by saying just remove them, don’t deduct (i.e. pay tax on ) the excess amounts, and declare any earnings as other income. Could be worse.

Since dollars in your HSA are fungible, it is very difficult to determine exactly which investment they were put into and from where they should be removed. This makes it difficult to determine the exact earnings for the dollars specifically declared excess contributions. Thus, the IRS permits an “average” determination of the gains of the HSA during that time, and the pro rata share of those average gains that can be attributed to excess contributions.

Forms for Removing Excess Contributions

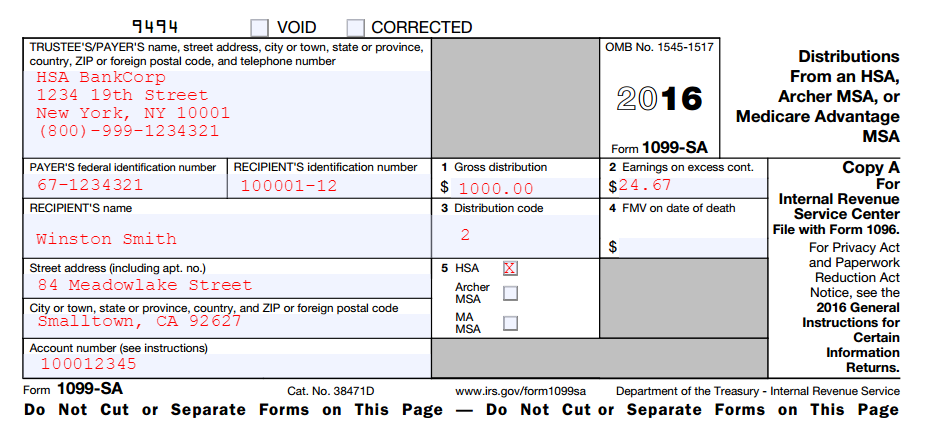

You will need to specifically inform your HSA trustee of a correction and that you wish to remove an excess contribution to your HSA. This triggers them to classify the transaction separately, as opposed to a normal withdrawal for qualified medical expenses. They will proceed to file an additional Form 1099-SA showing the excess contribution being distributed from the HSA with a distribution code of “2”. Be sure to remove and identify any earnings on the excess contribution as well. This form will be provided to you to indicate 1) a distribution from the account that 2) was for excess contributions. The form will look something like this:

The other thing that should occur is your HSA trustee will correct your Form 5498-SA which shows HSA contributions for the year. While they initially would have included your excess contribution (they didn’t know it was excess), once you alert them and withdraw it, they will remove it from Form 5498-SA. That means that your Form 5498-SA will be accurate for the year and should not include any excess contributions.

Option 2: Apply to a Future Year

Alternatively, you can use an excess contribution as your HSA contribution in a future year. You just let your excess contribution sit and then apply it later; the downside is there is a 6% per year penalty. The mechanism that allows this is the deduction, since next year you won’t actually deposit the contribution (it is already there), you will just deduct it on Form 8889. As an example, if you have excess contributions in 2016, you can let them sit there until 2017 and then use them as your contribution for 2017. Rolling an excess contribution to a future year is allowed per the IRS Form 969:

You may be able to deduct excess contributions for previous years that are still in your HSA. The excess contribution you can deduct for the current year is the lesser of the following two amounts:

1) Your maximum HSA contribution limit for the year minus any amounts contributed to your HSA for the year.

2) The total excess contributions in your HSA at the beginning of the year.

So the IRS allows you to roll forward excess contributions and not remove them, but apply them to future periods. You can’t apply more than you have in excess and you can’t apply more than that year’s HSA contribution limit. The downside to this plan is that you must pay the 6% excise tax on the excess contribution for each year it remains in your account as excess (i.e. not applied).

Removal Deadline

To avoid penalty, you must remove excess HSA contributions in the year that they occur. This must be done before your tax filing deadline. Note that this includes extensions, so filing an extension on your taxes increases the amount of time you have to remove the excess. If you elect to apply the over contribution to a subsequent tax year’s HSA, the deadline is the same. While you will eat the 6% penalty the first year, you have until you file your taxes to declare the excess a contribution and deduct it from your taxes.

Excess Employer Contributions to an HSA

While employer contributions are normally a great thing, they can cause some pain should they become excessive (hah!). Since employer contributions to your Health Savings Account count toward your yearly contribution limit, you must factor them into your limit. Three situations can arise from employer contributions:

- Employer and Employee over contribute – If both you and your employer contribute to your HSA, the onus is on you to not over contribute. Thus any over contribution is from the employee and the employer cannot claw back their contribution (see next section).

- Employer alone over contributes – In this case, the employer can file to have the contributions (and earnings) returned by December 31st. If they fail to do this, the excess amounts will be filed as income on the W-2 and the excess will need to be removed by the employee.

- Employer contributes to ineligible individual – The unlikely event that an employee is not eligible but receives HSA contributions functions much like the above example. If it is caught by December 31st, it can be recovered, but after that it becomes wages and the monies do not function as an HSA (just a regular account).

————————————

Note: if you have an HSA, please consider using my service EasyForm8889.com to complete Form 8889. It is fast and painless, no matter how complicated your HSA excess contributions may be.